3M 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 Steadfast Amid Uncertainty

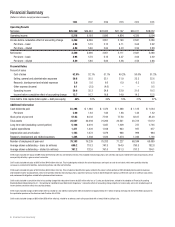

Financial Summary

(Dollars in millions, except per share amounts)

2008 2007 2006 2005 2004 2003

Operating Results

Net sales $25,269 $24,462 $22,923 $21,167 $20,011 $18,232

Operating income 5,218 6,193 5,696 4,854 4,326 3,504

Income before cumulative effect of accounting change 3,460 4,096 3,851 3,146 2,841 2,286

Per share – basic 4.95 5.70 5.15 4.11 3.64 2.92

Per share – diluted 4.89 5.60 5.06 4.03 3.56 2.88

Net income 3,460 4,096 3,851 3,111 2,841 2,286

Per share – basic 4.95 5.70 5.15 4.07 3.64 2.92

Per share – diluted 4.89 5.60 5.06 3.98 3.56 2.88

Financial Ratios

Percent of sales

Cost of sales 52.9% 52.1% 51.1% 49.2% 50.0% 51.2%

Selling, general and administrative expenses 20.8 20.5 22.1 21.9 22.2 22.6

Research, development and related expenses 5.6 5.6 6.6 6.0 6.2 6.5

Other expense (income) 0.1 (3.5) (4.6) – – 0.5

Operating income 20.6 25.3 24.8 22.9 21.6 19.2

Income before cumulative effect of accounting change 13.7 16.7 16.8 14.9 14.2 12.5

Total debt to total capital (total capital = debt plus equity) 40% 30% 26% 19% 21% 27%

Additional Information

Cash dividends paid $1,398 $ 1,380 $ 1,376 $ 1,286 $ 1,125 $ 1,034

Per share 2.00 1.92 1.84 1.68 1.44 1.32

Stock price at year-end 57.54 84.32 77.93 77.50 82.07 85.03

Total assets 25,547 24,694 21,294 20,541 20,723 17,612

Long-term debt (excluding current portion) 5,166 4,019 1,047 1,309 727 1,735

Capital expenditures 1,471 1,422 1,168 943 937 677

Depreciation and amortization 1,153 1,072 1,079 986 999 964

Research, development and related expenses 1,404 1,368 1,522 1,274 1,246 1,190

Number of employees at year-end 79,183 76,239 75,333 71,227 68,244 68,089

Average shares outstanding – basic (in millions) 699.2 718.3 747.5 764.9 780.5 782.8

Average shares outstanding – diluted (in millions) 707.2 732.0 761.0 781.3 797.3 794.1

2008 results included net losses of $269 million ($194 million after tax and minority interest). This included restructuring actions, exit activities and losses related to the sale of businesses, which

were partially offset by a gain on sale of real estate.

2007 results included net gains of $681 million ($448 million after tax). This included gains related to the sale of businesses and a gain on sale of real estate, which were partially offset by

increases in environmental liabilities, restructuring actions and other exit activities.

2006 results included net gains of $523 million ($438 million after tax). This included net benefits from gains related to the sale of certain portions of 3M’s branded pharmaceuticals business

and favorable income tax adjustments, which were partially offset by restructuring actions, acquired in-process research and development expenses, settlement costs of an antitrust class action,

and environmental obligations related to the pharmaceuticals business.

2005 results included a cumulative effect of accounting change that reduced net income by $35 million after tax, or 5 cents per diluted share, related to the adoption of Financial Accounting

Standards Board Interpretation No. 47, “Accounting for Conditional Asset Retirement Obligations.” Cumulative effect of accounting change impacts net income only, and is not included as part of

income before cumulative effect of accounting change.

2005 results included charges of $75 million after tax related to a tax liability resulting from 3M’s reinvestment of approximately $1.7 billion of foreign earnings into the United States pursuant to

the repatriation provision of the American Jobs Creation Act of 2004.

2003 results included charges of $93 million ($58 million after tax), related to an adverse court ruling associated with a lawsuit filed by LePage’s Inc.