UPS 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

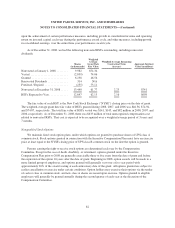

Accumulated Other Comprehensive Income (Loss)

We incur activity in AOCI for unrealized holding gains and losses on available-for-sale securities, foreign

currency translation adjustments, unrealized gains and losses from derivatives that qualify as hedges of cash

flows, and unrecognized pension and postretirement benefit costs. The activity in AOCI is as follows (in

millions):

2008 2007 2006

Foreign currency translation gain (loss):

Balance at beginning of year ....................................... $ 81 $ (109) $ (163)

Aggregate adjustment for the year ................................... (119) 190 54

Balance at end of year ............................................ (38) 81 (109)

Unrealized gain (loss) on marketable securities, net of tax:

Balance at beginning of year ....................................... 9 12 11

Current period changes in fair value (net of tax effect of $(33), $4, and

$(3)) ........................................................ (78) 6 (4)

Reclassification to earnings (net of tax effect of $5, $(5), and $3) .......... 9 (9) 5

Balance at end of year ............................................ (60) 9 12

Unrealized gain (loss) on cash flow hedges, net of tax:

Balance at beginning of year ....................................... (250) 68 83

Current period changes in fair value (net of tax effect of $(33), $(177), and

$(4)) ........................................................ (54) (294) (7)

Reclassification to earnings (net of tax effect of $118, $(14), and $(5)) ...... 197 (24) (8)

Balance at end of year ............................................ (107) (250) 68

Unrecognized pension and postretirement benefit costs, net of tax:

Balance at beginning of year ....................................... (1,853) (2,176) (95)

Reclassification to earnings (net of tax effect of $81, $73, and $0) ......... 133 122 —

Net actuarial gain / loss and prior service cost resulting from remeasurements

of plan assets and liabilities (net of tax effect of $(2,235), $111, and

$11) ......................................................... (3,717) 201 16

FAS 158 transition adjustment (net of tax effect $(1,258) in 2006) ......... — — (2,097)

Balance at end of year ............................................ (5,437) (1,853) (2,176)

Accumulated other comprehensive income (loss) at end of year ............... $(5,642) $(2,013) $(2,205)

As discussed in Note 5, we adopted the recognition and disclosure provisions of FAS 158 on December 31,

2006. The adoption of FAS 158 required us to eliminate the previous minimum pension liability charge to AOCI,

and to record a charge, net of tax, to AOCI representing the unrecognized pension and postretirement benefit

costs as of December 31, 2006.

Deferred Compensation Obligations and Treasury Stock

We maintain a deferred compensation plan whereby certain employees were previously able to elect to defer

the gains on stock option exercises by deferring the shares received upon exercise into a rabbi trust. The shares

held in this trust are classified as treasury stock, and the liability to participating employees is classified as

“deferred compensation obligations” in the shareowners’ equity section of the balance sheet. The number of

shares needed to settle the liability for deferred compensation obligations is included in the denominator in both

80