Travelzoo 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 Travelzoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

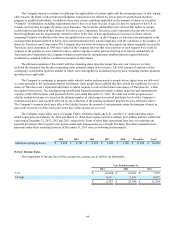

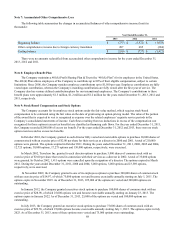

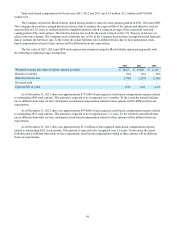

In July 2012, the Company announced a stock repurchase program authorizing the repurchase of up to 1,000,000 shares

of the Company’s outstanding common stock. During the three months ended September 30, 2012, the Company repurchased

161,000 shares of common stock for an aggregate purchase price of $3.6 million. The 161,000 shares repurchased were retired

as of September 30, 2012. During the three months ended December 31, 2012, the Company repurchased 439,000 shares of

common stock for an aggregate purchase price of $7.9 million. The 439,000 shares repurchased were recorded as part of

treasury stock as of December 31, 2012.

During the year ended December 31, 2013, the Company repurchased 371,000 shares of common stock for an aggregate

purchase price of $7.8 million. The 371,000 shares repurchased were recorded as part of treasury stock as of December 31,

2013.

In January 2014, the Company announced a stock repurchase program authorizing the repurchase of up to 500,000 shares

of the Company’s outstanding common stock.

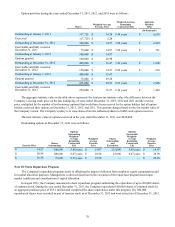

Note 11: Reverse/Forward Stock Split

On June 11, 2013, a Special Committee of the Company’s Board of Directors, consisting of three independent directors,

unanimously approved a reverse/forward stock split transaction (collectively referred to as the “reverse/forward split”), subject

to shareholder approval. The reverse/forward split was intended to reduce the Company’s shareholder account administration

costs by reducing the number of its shareholders.

On September 12, 2013, at the Company’s annual shareholders meeting, Travelzoo shareholders voted in favor of the

reverse/forward split, with the transaction receiving the votes of both (A) a majority of the issued and outstanding shares of

common stock and (B) a majority of the issued and outstanding shares of common stock that are not held or controlled, directly

or indirectly, by directors or officers of the Company, including, without limitation, the shares held by Azzurro Capital Inc., our

principal stockholder.

On November 6, 2013, the Special Committee approved the execution of the transaction after receiving an opinion from a

financial advisor regarding the fairness of the transaction from a financial point of view to the Company's shareholders whose

positions, individually considered, consisted of fewer than 25 shares, of the per-share consideration to be received by such

shareholders in the reverse/forward split. The Special Committee received legal counsel from Young Conaway Stargatt &

Taylor, LLP in connection with its review of the transaction. In addition, the Company received legal counsel from Skadden,

Arps, Slate, Meagher & Flom LLP and Bryan Cave LLP in connection with the transaction.

On November 6, 2013, based upon the Special Committee’s approval of the transaction and the receipt of a fairness

opinion from the financial advisor, the Company executed the shareholder approved reverse/forward split.

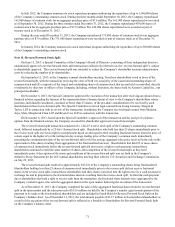

The reverse/forward split transaction consisted of a 1-for-25 reverse stock split of the Company's outstanding common

stock, followed immediately by a 25-for-1 forward stock split. Shareholders who held less than 25 shares immediately prior to

the reverse stock split received a right to cash payment based on and equal to their resulting fractional interest times the price of

a share equal to the higher of (a) the trailing ten day average trading price of the Company’s common stock immediately

preceding the consummation date of the reverse/forward split or (b) the average aggregate sales price received in the sale on the

open market of the shares resulting from aggregation of the fractionalized interests. Shareholders that held 25 or more shares

of common stock immediately before the reverse/forward split did not receive a right to cash payment; instead these

shareholders continued to hold the same number of shares after completion of the reverse/forward split as they held

immediately prior. A description of the terms and conditions of the reverse/forward split was set forth in the Company’s

definitive Proxy Statement for the 2013 annual shareholders meeting filed with the U.S. Securities and Exchange Commission

on July 25, 2013.

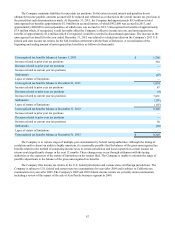

The reverse/forward split resulted in approximately 643,218 of the Company’s outstanding shares being fractionalized.

Shareholders holding less than 25 shares of common stock immediately prior to the reverse split did not receive fractional

shares in the reverse stock split; instead these shareholders had their shares converted into the right to receive a cash payment in

exchange for and in proportion to the fractional share interests resulting from the reverse stock split. To fund the cash payment

due to shareholders that held a right to receive cash from the transaction, the fractional share interests were aggregated by the

Company’s transfer agent, who sold the aggregated shares in the open market following the execution of the transaction.

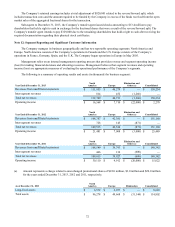

As of December 31, 2013, the Company completed the sales of the aggregated fractional shares from the reverse/forward

split in the open market and the sales proceeds of $13.6 million are held by the Company’s transfer agent in anticipation of the

payment to be made to the fractionalized shareholders and are included in Funds Held for Reverse/Forward Stock Split on the

Company’s balance sheet. As of December 31, 2013, the total amount payable of $13.7 million to fractionalized shareholders as

a result of the execution of the reverse/forward split is reflected as a Payable to Shareholders for Reverse/Forward Stock Split

on the Company’s balance sheet.