Rite Aid 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities.

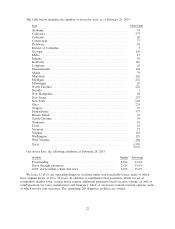

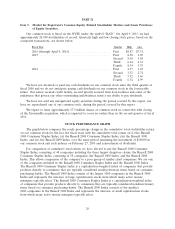

Our common stock is listed on the NYSE under the symbol ‘‘RAD.’’ On April 9, 2015, we had

approximately 20,940 stockholders of record. Quarterly high and low closing stock prices, based on the

composite transactions, are shown below.

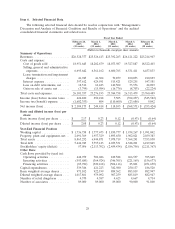

Fiscal Year Quarter High Low

2016 (through April 9, 2015) ....................... First $8.87 $7.31

2015 ........................................ First 8.38 6.05

Second 8.50 5.98

Third 6.64 4.51

Fourth 8.34 5.39

2014 ........................................ First 2.97 1.65

Second 3.52 2.74

Third 5.92 3.46

Fourth 6.74 4.99

We have not declared or paid any cash dividends on our common stock since the third quarter of

fiscal 2000 and we do not anticipate paying cash dividends on our common stock in the foreseeable

future. Our senior secured credit facility, second priority secured term loan facilities and some of the

indentures that govern our other outstanding indebtedness restrict our ability to pay dividends.

We have not sold any unregistered equity securities during the period covered by this report, nor

have we repurchased any of our common stock, during the period covered by this report.

We expect to issue approximately 27.9 million shares of common stock in connection with closing

of the EnvisionRx acquisition, which is expected to occur no earlier than in the second quarter of fiscal

2016.

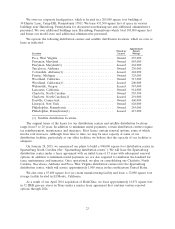

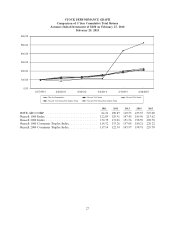

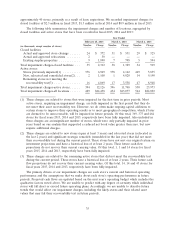

STOCK PERFORMANCE GRAPH

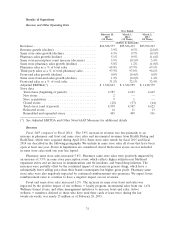

The graph below compares the yearly percentage change in the cumulative total stockholder return

on our common stock for the last five fiscal years with the cumulative total return on (i) the Russell

1000 Consumer Staples Index, (ii) the Russell 2000 Consumer Staples Index, (iii) the Russell 1000

Index, and (iv) the Russell 2000 Index, over the same period (assuming the investment of $100.00 in

our common stock and such indexes on February 27, 2010 and reinvestment of dividends).

For comparison of cumulative total return, we have elected to use the Russell 1000 Consumer

Staples Index, consisting of 48 companies including the three largest drugstore chains, the Russell 2000

Consumer Staples Index, consisting of 58 companies, the Russell 1000 Index, and the Russell 2000

Index. This allows comparison of the company to a peer group of similar sized companies. We are one

of the companies included in the Russell 1000 Consumer Staples Index and the Russell 1000 Index.

The Russell 1000 Consumer Staples Index is a capitalization-weighted index of companies that provide

products directly to consumers that are typically considered nondiscretionary items based on consumer

purchasing habits. The Russell 1000 Index consists of the largest 1000 companies in the Russell 3000

Index and represents the universe of large capitalization stocks from which many active money

managers typically select. The Russell 2000 Consumer Staples Index is a capitalization-weighted index

of companies that provide products directly to consumers that are typically considered nondiscretionary

items based on consumer purchasing habits. The Russell 2000 Index consists of the smallest

2000 companies in the Russell 3000 Index and represents the universe of small capitalization stocks

from which many active money managers typically select.

26