American Airlines 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

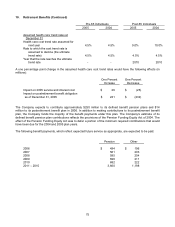

9. Stock Awards and Options (Continued)

The weighted-average grant date fair value per share (calculated using a Black-Scholes option pricing model) of

all stock option awards granted during 2005, 2004 and 2003 was $6.28, $4.23 and $2.32, respectively.

Shares of deferred stock were awarded at no cost to officers and key employees under the LTIP Plans’ Career

Equity Program and will be issued upon the individual's retirement from AMR or, in certain circumstances, will

vest on a pro rata basis. Deferred stock activity was:

Year Ended December 31,

2005 2004 2003

Outstanding at January 1 2,200,664 2,463,061 3,596,508

Granted 83,000 - -

Issued (74,609) (213,092) (858,262)

Canceled (42,527) (49,305) (275,185)

Outstanding at December 31 2,166,528 2,200,664 2,463,061

A performance share plan was implemented in 1993 under the terms of which shares of deferred stock are

awarded at no cost to officers and key employees under the LTIP Plans and, beginning in 2003, under the 2003

Plan. The fair value of the performance shares granted is equal to the market price of the Company’s stock at the

date of grant. The shares vest over a three-year performance period based upon certain specified financial

measures of the Company. Performance share activity was:

Year Ended December 31,

2005 2004 2003

Outstanding at January 1 830,134 1,570,498 1,230,104

Granted - 550 512,885

Issued (53,955) (153,549) -

Awards settled in cash (561,313) (540,749) -

Canceled (214,866) (46,616) (172,491)

Outstanding at December 31 - 830,134 1,570,498

The weighted-average grant date fair value per share of performance share awards granted during 2004 and

2003 was $16.36 and $10.50, respectively. No performance share awards were granted during 2005.

In 2005, 2004 and 2003, the total charge for stock-based compensation expense included in wages, salaries and

benefits expense, primarily related to the Company’s performance unit and share plans (of which there are three

active plans at any given point in time), was $132 million, $21 million and $20 million, respectively. No

compensation expense was recognized for stock option grants under the LTIP Plans or the 2003 Plan, since the

exercise price was equal to the fair market value of the underlying stock on the date of grant.