HP 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

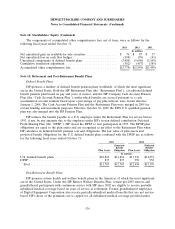

Note 14: Stockholders’ Equity (Continued)

The components of accumulated other comprehensive loss, net of taxes, were as follows for the

following fiscal years ended October 31:

2013 2012 2011

In millions

Net unrealized gain on available-for-sale securities ................. $ 76 $ 87 $ 37

Net unrealized loss on cash flow hedges ......................... (188) (99) (41)

Unrealized components of defined benefit plans ................... (3,084) (5,090) (3,109)

Cumulative translation adjustment ............................. (582) (457) (385)

Accumulated other comprehensive loss .......................... $(3,778) $(5,559) $(3,498)

Note 15: Retirement and Post-Retirement Benefit Plans

Defined Benefit Plans

HP sponsors a number of defined benefit pension plans worldwide, of which the most significant

are in the United States. Both the HP Retirement Plan (the ‘‘Retirement Plan’’), a traditional defined

benefit pension plan based on pay and years of service, and the HP Company Cash Account Pension

Plan (the ‘‘Cash Account Pension Plan’’), under which benefits are accrued pursuant to a cash

accumulation account formula based upon a percentage of pay plus interest, were frozen effective

January 1, 2008. The Cash Account Pension Plan and the Retirement Plan were merged in 2005 for

certain funding and investment purposes. Effective October 30, 2009 the EDS U.S. qualified pension

plan was also merged into the HP Pension Plan.

HP reduces the benefit payable to a U.S. employee under the Retirement Plan for service before

1993, if any, by any amounts due to the employee under HP’s frozen defined contribution Deferred

Profit-Sharing Plan (the ‘‘DPSP’’). HP closed the DPSP to new participants in 1993. The DPSP plan

obligations are equal to the plan assets and are recognized as an offset to the Retirement Plan when

HP calculates its defined benefit pension cost and obligations. The fair value of plan assets and

projected benefit obligations for the U.S. defined benefit plans combined with the DPSP are as follows

for the following fiscal years ended October 31:

2013 2012

Projected Projected

Benefit Benefit

Plan Assets Obligation Plan Assets Obligation

In millions

U.S. defined benefit plans ....................... $10,866 $11,866 $11,536 $14,237

DPSP...................................... 837 837 958 958

Total ..................................... $11,703 $12,703 $12,494 $15,195

Post-Retirement Benefit Plans

HP sponsors retiree health and welfare benefit plans in the Americas, of which the most significant

are in the United States. Under the HP Retiree Welfare Benefits Plan, certain pre-2003 retirees and

grandfathered participants with continuous service with HP since 2002 are eligible to receive partially-

subsidized medical coverage based on years of service at retirement. Former grandfathered employees

of Digital Equipment Corporation also receive partially-subsidized medical benefits that are not service-

based. HP’s share of the premium cost is capped for all subsidized medical coverage provided under

136