Napa Auto Parts 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

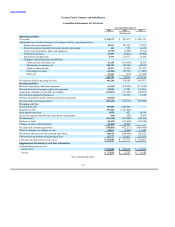

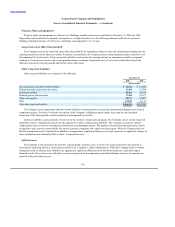

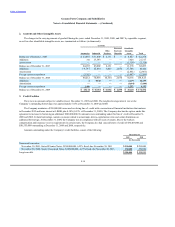

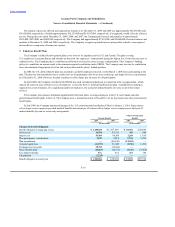

Property, plant, and equipment are stated at cost. Buildings include certain leases capitalized at December 31, 2009 and 2008.

Depreciation and amortization is primarily determined on a straight-line basis over the following estimated useful life of each asset:

buildings and improvements, 10 to 40 years; machinery and equipment, 5 to 15 years.

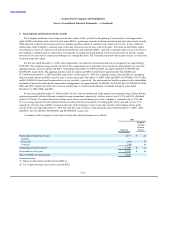

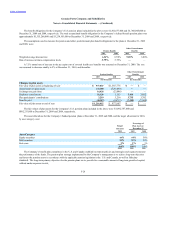

The Company assesses its long-lived assets other than goodwill for impairment whenever facts and circumstances indicate that the

carrying amount may not be fully recoverable. To analyze recoverability, the Company projects undiscounted net future cash flows over

the remaining life of such assets. If these projected cash flows are less than the carrying amount, an impairment would be recognized,

resulting in a write-down of assets with a corresponding charge to earnings. Impairment losses, if any, are measured based upon the

difference between the carrying amount and the fair value of the assets.

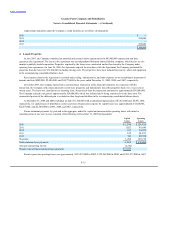

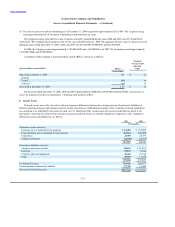

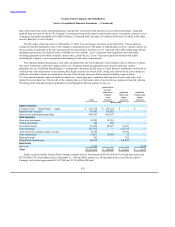

Other long-term liabilities are comprised of the following:

Post-employment and other benefit liabilities $ 10,920

Obligations under capital and other leases 12,708

Insurance liabilities 43,019

Deferred gain on sale-leaseback 18,477

Other taxes payable 12,027

Other 6,113

Total other long-term liabilities $103,264

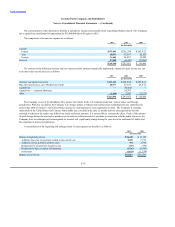

The Company’s post-employment and other benefit liabilities consist primarily of actuarially determined obligations and deferred

compensation plans. See Note 4 for further discussion of the Company’s obligations under capital leases and the sale-leaseback

transaction. Other taxes payable consists primarily of unrecognized tax benefits.

Insurance liabilities consist primarily of reserves for the workers’ compensation program. The Company carries various large risk

deductible workers’ compensation policies for the majority of workers’ compensation liabilities. The Company records the workers’

compensation reserves based on an analysis performed by an independent actuary. The analysis calculates development factors, which

are applied to total reserves as provided by the various insurance companies who underwrite the program. While the Company believes

that the assumptions used to calculate these liabilities are appropriate, significant differences in actual experience or significant changes in

these assumptions may materially affect workers’ compensation costs.

The Company is self-insured for the majority of group health insurance costs. A reserve for claims incurred but not reported is

developed by analyzing historical claims data provided by the Company’s claims administrators. While the Company believes that the

assumptions used to calculate these liabilities are appropriate, significant differences from historical trends may materially impact

financial results. These reserves are included in accrued expenses in the accompanying consolidated balance sheets as the expenses are

expected to be paid within one year.

F-11