TCF Bank 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Form10-K 71

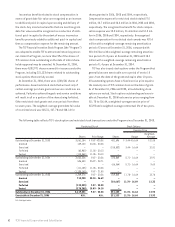

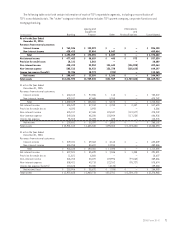

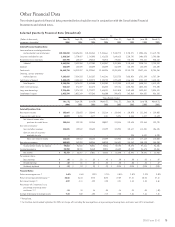

The following table sets forth certain information of each of TCF’s reportable segments, including a reconciliation of

TCF’s consolidated totals. The “other” category in the table below includes TCF’s parent company, corporate functions and

mortgage banking.

Leasing and Eliminations

Equipment and

(In thousands) Banking Finance Other Reclassifications Consolidated

At or For the Year Ended

December 31, 2006:

Revenues from external customers:

Interest income $ 763,846 $ 122,292 $ – $ – $ 886,138

Non-interest income 428,413 53,004 8,047 – 489,464

Total $ 1,192,259 $ 175,296 $ 8,047 $ – $ 1,375,602

Net interest income $ 477,453 $ 58,659 $ 445 $ 973 $ 537,530

Provision for credit losses 18,121 2,568 – – 20,689

Non-interest income 428,413 53,004 134,645 (126,598) 489,464

Non-interest expense 585,512 56,932 132,378 (125,625) 649,197

Income tax expense (benefit) 93,786 18,773 (394) – 112,165

Net income $ 208,447 $ 33,390 $ 3,106 $ – $ 244,943

Total assets $14,256,595 $1,989,230 $131,509 $(1,707,600) $14,669,734

At or For the Year Ended

December 31, 2005:

Revenues from external customers:

Interest income $ 634,312 $ 97,596 $ 114 $ – $ 732,022

Non-interest income 425,017 47,465 5,760 – 478,242

Total $ 1,059,329 $ 145,061 $ 5,874 $ – $ 1,210,264

Net interest income $ 455,549 $ 57,014 $ 2,780 $ 2,347 $ 517,690

Provision for credit losses 4,593 3,993 – – 8,586

Non-interest income 425,017 47,465 125,337 (119,577) 478,242

Non-interest expense 549,586 48,596 125,984 (117,230) 606,936

Income tax expense 96,505 18,493 280 – 115,278

Net income $ 229,882 $ 33,397 $ 1,853 $ – $ 265,132

Total assets $ 12,931,312 $ 1,635,528 $ 195,355 $ (1,373,601) $ 13,388,594

At or For the Year Ended

December 31, 2004:

Revenues from external customers:

Interest income $ 529,281 $ 89,364 $ 4,164 $ – $ 622,809

Non-interest income 426,255 50,697 12,934 – 489,886

Total $ 955,536 $ 140,061 $ 17,098 $ – $ 1,112,695

Net interest income $ 427,521 $ 55,699 $ 7,336 $ 1,335 $ 491,891

Provision for credit losses 11,821 6,806 – – 18,627

Non-interest income 426,255 50,697 109,996 (97,062) 489,886

Non-interest expense 508,421 43,718 122,262 (95,727) 578,674

Income tax expense (benefit) 113,628 20,000 (4,145) – 129,483

Net income (loss) $ 219,906 $ 35,872 $ (785) $ – $ 254,993

Total assets $ 11,927,658 $ 1,460,778 $ 212,701 $ (1,224,172) $ 12,376,965