DTE Energy 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 DTE Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

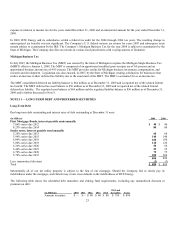

The fair values of the Company’ s plans assets at December 31, 2009, by asset category are as follows:

Fair Value Measurements at December 31, 2009

(in Millions)(a)

Level 1

Level 2

Level 3

Balance at

December 31, 2009

Asset Category:

Short-term investments (b) ......................................................................

$ —

$ 21

$ —

$ 21

Equity securities

U.S. Large Cap(c) ................................................................................. 217 10 — 227

U.S. Small/Mid Cap(d) .........................................................................

51

1

—

52

Non U.S(e). ..........................................................................................

76

40

—

116

Fixed income securities(f) ........................................................................

15

198

—

213

Other types of investments

Hedge Funds and Similar Investments(g) ............................................

—

—

160

160

Private Equity and Other(h). ................................................................

—

—

53

53

Total

$ 359

$ 270

$ 213

$ 842

(a) See Note 4 – Fair Value for a description of levels within the fair value hierarchy.

(b) This category predominately represents certain short-term fixed income securities and money market investments that are managed

in separate accounts or commingled funds. Pricing for investments in this category are obtained from quoted prices in actively

traded markets or valuations from broker or pricing services.

(c) This category comprises both actively and not actively managed portfolios that track the S&P 500 low cost equity index funds.

Investments in this category are exchange-traded securities whereby unadjusted quote prices can be obtained. Exchange-traded

securities held in a commingled fund are classified as Level 2 assets.

(d) This category represents portfolios of small and medium mid capitalization domestic equities. Investments in this category are

exchange-traded securities whereby unadjusted quote prices can be obtained. Exchange-traded securities held in a commingled

fund are classified as Level 2 assets.

(e) This category primarily consists of portfolios of non-U.S. developed and emerging market equities. Investments in this category

are exchange-traded securities whereby unadjusted quote prices can be obtained. Exchange-traded securities held in a commingled

fund are classified as Level 2 assets.

(f) This category includes corporate bonds from diversified industries, U.S. Treasuries, and mortgage backed securities. Pricing for

investments in this category is obtained from quoted prices in actively traded markets and quotations from broker or pricing

services. Non-exchange traded securities and exchange-traded securities held in commingled funds are classified as Level 2 assets.

(g) This category includes a diversified group of funds and strategies that attempt to capture financial market inefficiencies. Pricing for

investments in this category is based on limited observable inputs as there is little, if any, publicly available pricing. Valuations

for assets in this category may be based on relative publicly-traded securities, derivatives, and privately-traded securities.

(h) This category includes a diversified group of funds and strategies that primarily invests in private equity partnerships. This

category also includes investments in timber and private mezzanine debt. Pricing for investments in this category is based on

limited observable inputs as there is little, if any, publicly available pricing. Valuations for assets in this category may be based on

discounted cash flow analyses, relative publicly-traded comparables and comparable transactions.

The pension trust holds debt and equity securities directly and indirectly through commingled funds and institutional mutual funds.

Exchange-traded debt and equity securities held directly are valued using quoted market prices in actively traded markets. The