eBay 2006 Annual Report Download - page 83

Download and view the complete annual report

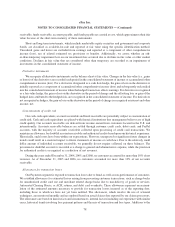

Please find page 83 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.allowance, in the form of provisions, are reflected as a general and administrative expense in our consolidated

statement of income. At December 31, 2005 and 2006, the allowance for transaction losses totaled $50.3 million

and $79.5 million, respectively, and was included as an offset to other current assets and accrued expenses and other

current liabilities in our consolidated balance sheet.

Foreign currency

The majority of our foreign subsidiaries use the local currency of their respective countries as their functional

currency. Assets and liabilities are translated at exchange rates prevailing at the balance sheet dates. Revenues, costs

and expenses are translated into United States dollars at average exchange rates for the period. Gains and losses

resulting from translation are recorded as a component of accumulated other comprehensive income (loss).

Realized gains and losses from foreign currency transactions are recognized as interest and other income, net.

Funds receivable and funds payable to customers

Funds receivable and payable relate to our Payments segment and arise due to the time taken to clear

transactions through external payment networks. When customers fund their account using their bank account or

credit card, or withdraw money from their bank account or through a debit card transaction, there is a clearing

period before the cash is received or sent by PayPal, usually one to three business days for U.S. transactions, and up

to five business days for international transactions. Hence, these funds are treated as a receivable or payable until the

cash is settled.

Customer accounts

Based on differences in regulatory requirements and commercial law in the jurisdictions where PayPal

operates, PayPal holds customer balances either as direct claims against PayPal or as an agent or custodian on behalf

of PayPal’s customers. Customer balances held as direct claims against PayPal are included on our consolidated

balance sheet as customer accounts with an offsetting current liability in funds payable and amounts due to

customers. The customer accounts can be invested only in specified types of liquid assets. Customer accounts on our

consolidated balance sheet as of December 31, 2006 included approximately $180 million from direct non-

custodial customer relationships established in conjunction with PayPal’s Asia Pacific headquarters during 2006.

All customer funds held by PayPal as an agent or custodian on behalf of our customers are not reflected in our

consolidated balance sheet. These off-balance sheet funds total approximately $1.2 billion and $1.5 billion as of

December 31, 2005 and 2006, respectively. These off-balance sheet funds include funds held in the U.S. that are

deposited in bank accounts insured by the Federal Deposit Insurance Corporation and funds that customers choose

to invest in PayPal’s Money Market Fund.

Property and equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation and amor-

tization are computed using the straight-line method over the estimated useful lives of the assets, generally, one to

three years for computer equipment and software, up to 30 years for buildings and building improvements, ten years

for aviation equipment, the shorter of five years or the term of the lease for leasehold improvements, three years for

furniture and fixtures and three years for vehicles.

Goodwill and intangible assets

Goodwill represents the excess of the purchase price over the fair value of the net tangible and identifiable

intangible assets acquired in a business combination. Intangible assets resulting from the acquisitions of entities

accounted for using the purchase method of accounting are estimated by management based on the fair value of

assets received. Identifiable intangible assets are comprised of purchased customer lists and user base, trademarks

79

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)