Cisco 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

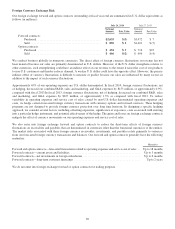

Notes to Consolidated Financial Statements

1. Basis of Presentation

The fiscal year for Cisco Systems, Inc. (the “Company” or “Cisco”) is the 52 or 53 weeks ending on the last Saturday in July.

Fiscal 2014, fiscal 2013, and fiscal 2012 are each 52-week fiscal years. The Consolidated Financial Statements include the

accounts of Cisco and its subsidiaries. All intercompany accounts and transactions have been eliminated. The Company

conducts business globally and is primarily managed on a geographic basis in the following three geographic segments: the

Americas; Europe, Middle East, and Africa (EMEA); and Asia Pacific, Japan, and China (APJC).

The Company consolidates its investments in a venture fund managed by SOFTBANK Corp. and its affiliates

(“SOFTBANK”) as this is a variable interest entity and the Company is the primary beneficiary. The noncontrolling interests

attributed to SOFTBANK are presented as a separate component from the Company’s equity in the equity section of the

Consolidated Balance Sheets. SOFTBANK’s share of the earnings in the venture fund are not presented separately in the

Consolidated Statements of Operations as these amounts are not material for any of the fiscal periods presented.

Certain reclassifications have been made to the amounts for prior years in order to conform to the current year’s presentation.

The Company has evaluated subsequent events through the date that the financial statements were issued.

2. Summary of Significant Accounting Policies

(a) Cash and Cash Equivalents The Company considers all highly liquid investments purchased with an original or remaining

maturity of three months or less at the date of purchase to be cash equivalents. Cash and cash equivalents are maintained with

various financial institutions.

(b) Available-for-Sale Investments The Company classifies its investments in both fixed income securities and publicly traded

equity securities as available-for-sale investments. Fixed income securities primarily consist of U.S. government securities,

U.S. government agency securities, non-U.S. government and agency securities, corporate debt securities, and U.S. agency

mortgage-backed securities. These available-for-sale investments are primarily held in the custody of a major financial

institution. A specific identification method is used to determine the cost basis of fixed income and public equity securities

sold. These investments are recorded in the Consolidated Balance Sheets at fair value. Unrealized gains and losses on these

investments, to the extent the investments are unhedged, are included as a separate component of accumulated other

comprehensive income (AOCI), net of tax. The Company classifies its investments as current based on the nature of the

investments and their availability for use in current operations.

(c) Other-than-Temporary Impairments on Investments When the fair value of a debt security is less than its amortized cost, it

is deemed impaired, and the Company will assess whether the impairment is other than temporary. An impairment is

considered other than temporary if (i) the Company has the intent to sell the security, (ii) it is more likely than not that the

Company will be required to sell the security before recovery of the entire amortized cost basis, or (iii) the Company does not

expect to recover the entire amortized cost basis of the security. If impairment is considered other than temporary based on

condition (i) or (ii) described earlier, the entire difference between the amortized cost and the fair value of the debt security is

recognized in earnings. If an impairment is considered other than temporary based on condition (iii), the amount representing

credit losses (defined as the difference between the present value of the cash flows expected to be collected and the amortized

cost basis of the debt security) will be recognized in earnings, and the amount relating to all other factors will be recognized in

other comprehensive income (OCI).

The Company recognizes an impairment charge on publicly traded equity securities when a decline in the fair value of a

security below the respective cost basis is judged to be other than temporary. The Company considers various factors in

determining whether a decline in the fair value of these investments is other than temporary, including the length of time and

extent to which the fair value of the security has been less than the Company’s cost basis, the financial condition and near-term

prospects of the issuer, and the Company’s intent and ability to hold the investment for a period of time sufficient to allow for

any anticipated recovery in market value.

Investments in privately held companies are included in other assets in the Consolidated Balance Sheets and are primarily

accounted for using either the cost or equity method. The Company monitors these investments for impairments and makes

reductions in carrying values if the Company determines that an impairment charge is required based primarily on the financial

condition and near-term prospects of these companies.

(d) Inventories Inventories are stated at the lower of cost or market. Cost is computed using standard cost, which approximates

actual cost, on a first-in, first-out basis. The Company provides inventory write-downs based on excess and obsolete

inventories determined primarily by future demand forecasts. The write-down is measured as the difference between the cost

of the inventory and market based upon assumptions about future demand and charged to the provision for inventory, which is

a component of cost of sales. At the point of the loss recognition, a new, lower cost basis for that inventory is established, and

78