American Airlines 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

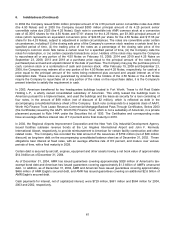

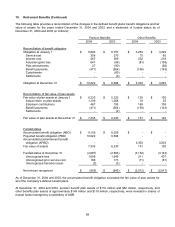

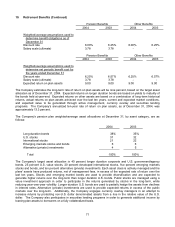

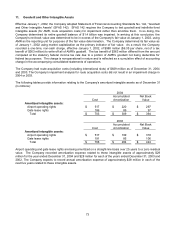

10. Retirement Benefits (Continued)

Pension Benefits Other Benefits

2004 2003 2004 2003

Weighted-average assumptions used to

determine benefit obligations as of

December 31

Discount rate 6.00% 6.25% 6.00% 6.25%

Salary scale (ultimate) 3.78 3.78 - -

Pension Benefits Other Benefits

2004 2003 2004 2003

Weighted-average assumptions used to

determine net periodic benefit cost for

the years ended December 31

Discount rate 6.25% 6.57% 6.25% 6.57%

Salary scale (ultimate) 3.78 3.78 - -

Expected return on plan assets 9.00 9.00 9.00 9.00

The Company estimates the long-term rate of return on plan assets will be nine percent, based on the target asset

allocation as of December 31, 2004. Expected returns on longer duration bonds are based on yields to maturity of

the bonds held at year-end. Expected returns on other assets are based on a combination of long-term historical

returns, actual returns on plan assets achieved over the last ten years, current and expected market conditions,

and expected value to be generated through active management, currency overlay and securities lending

programs. The Company’s annualized ten-year rate of return on plan assets, as of December 31, 2004, was

approximately 13.3 percent.

The Company’s pension plan weighted-average asset allocations at December 31, by asset category, are as

follows:

2004 2003

Long duration bonds 38% 35%

U.S. stocks 31 32

International stocks 21 22

Emerging markets stocks and bonds 6 6

Alternative (private) investments 4 5

Total 100% 100%

The Company’s target asset allocation is 40 percent longer duration corporate and U.S. government/agency

bonds, 25 percent U.S. value stocks, 20 percent developed international stocks, five percent emerging markets

stocks and bonds, and ten percent alternative (private) investments. Each asset class is actively managed and the

plans’ assets have produced returns, net of management fees, in excess of the expected rate of return over the

last ten years. Stocks and emerging market bonds are used to provide diversification and are expected to

generate higher returns over the long-term than longer duration U.S. bonds. Public stocks are managed using a

value investment approach in order to participate in the returns generated by stocks in the long-term, while

reducing year-over-year volatility. Longer duration U.S. bonds are used to partially hedge the assets from declines

in interest rates. Alternative (private) investments are used to provide expected returns in excess of the public

markets over the long-term. Additionally, the Company engages currency overlay managers in an attempt to

increase returns by protecting non-U.S. dollar denominated assets from a rise in the relative value of the U.S.

dollar. The Company also participates in securities lending programs in order to generate additional income by

loaning plan assets to borrowers on a fully collateralized basis.