DTE Energy 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 DTE Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

(d) This category represents portfolios of small and medium capitalization domestic equities. Investments in this category are

exchange-traded securities whereby unadjusted quote prices can be obtained. Exchange-traded securities held in a commingled

fund are classified as Level 2 assets.

(e) This category primarily consists of portfolios of non-U.S. developed and emerging market equities. Investments in this category

are exchange-traded securities whereby unadjusted quote prices can be obtained. Exchange-traded securities held in a commingled

fund are classified as Level 2 assets.

(f) This category includes corporate bonds from diversified industries, U.S. Treasuries, and mortgage backed securities. Pricing for

investments in this category is obtained from quoted prices in actively traded markets and quotations from broker or pricing

services. Non-exchange traded securities and exchange-traded securities held in commingled funds are classified as Level 2 assets.

g) This category includes a diversified group of funds and strategies that attempt to capture financial market inefficiencies. In 2009,

pricing for investments in this category was based on limited observable inputs as there was little, if any, publicly available

pricing. Valuations for assets in this category may be based on relevant publicly-traded securities, derivatives, and privately-

traded securities. In 2010, pricing for investments in this category included quoted prices in active markets and quotations from

broker or pricing services. Non-exchanged traded securities held in commingled funds are classified as Level 2 assets.

(h) This category includes a diversified group of funds and strategies that primarily invests in private equity partnerships. Pricing for

investments in this category is based on limited observable inputs as there is little, if any, publicly available pricing. Valuations for

assets in this category may be based on discounted cash flow analyses, relative publicly-traded comparables and comparable

transactions.

The VEBA trusts hold debt and equity securities directly and indirectly through commingled funds and institutional mutual funds.

Exchange-traded debt and equity securities held directly are valued using quoted market prices in actively traded markets. The

commingled funds and institutional mutual funds which hold exchange-traded equity or debt securities are valued based on underlying

securities, using quoted prices in actively traded markets. Non-exchange traded fixed income securities are valued by the trustee

based upon quotations available from brokers or pricing services. A primary price source is identified by asset type, class or issue for

each security. The trustees monitor prices supplied by pricing services and may use a supplemental price source or change the primary

price source of a given security if the trustees challenge an assigned price and determine that another price source is considered to be

preferable. MichCon has obtained an understanding of how these prices are derived, including the nature and observability of the

inputs used in deriving such prices. Additionally, MichCon selectively corroborates the fair values of securities by comparison of

market-based price sources.

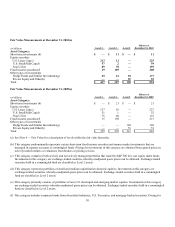

Fair Value Measurements Using Significant Unobservable Inputs (Level 3):

(in Millions)

HedgeFunds

and Similar

Investments

Private

Equityand

Other

Total

Beginning Balance at January 1, 2010

$ 29

$ 14

$ 43

Total realized/unrealized gains (losses)

3

3

6

Purchases, sales and settlements

(5)

1

(4)

Ending Balance at December 31, 2010

$ 27

$ 18

$ 45

The amount of total gains (losses) for the period attributable

to the change in unrealized gains or losses related to assets

still held at the end of the period

$ 2

$ 2

$ 4