Tesco 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008 47

Clubcard and loyalty initiatives

The cost of Clubcard is treated as a cost of sale, with an accrual equal to

the estimated fair value of the points issued recognised when the original

transaction occurs. On redemption, the cost of redemption is offset against

the accrual.

The fair value of the points awarded is determined with reference to the

cost of redemption and considers factors such as redemption via Clubcard

deals versus money-off in-store and redemption rate.

Computers for Schools and Sport for Schools and Clubs vouchers are

issued by Tesco for redemption by participating schools/clubs and are part

of our overall Community Plan. The cost of the redemption (i.e. meeting

the obligation attached to the vouchers) is treated as a cost rather than

as a deduction from sales.

Other income

Finance income is recognised in the period to which it relates on an

accruals basis. Dividends are recognised when a legal entitlement to

payment arises.

Operating profit

Operating profit is stated after profit arising on property-related items but

before the share of results of joint ventures and associates, finance income

and finance costs.

Discontinued operations

A discontinued operation is a component of the Group’s business that

represents a separate line of business or geographical area of operation.

Classification as a discontinued operation occurs upon disposal or earlier,

if the operation meets the criteria to be classified as held for sale, under

IFRS 5 ‘Non-current assets held for sale’.

Property, plant and equipment

Property, plant and equipment assets are carried at cost less accumulated

depreciation and any recognised impairment in value.

Property, plant and equipment assets are depreciated on a straight-line

basis to their residual value over their anticipated useful economic lives.

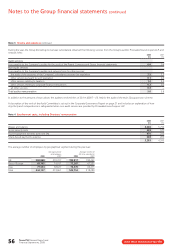

The following depreciation rates are applied for the Group:

> Freehold and leasehold buildings with greater than 40 years unexpired –

at 2.5% of cost;

> Leasehold properties with less than 40 years unexpired are depreciated

by equal annual instalments over the unexpired period of the lease; and

> Plant, equipment, fixtures and fittings and motor vehicles – at rates

varying from 9% to 33%.

Assets held under finance leases are depreciated over their expected useful

lives on the same basis as owned assets or, when shorter, over the term of

the relevant lease.

All tangible fixed assets are reviewed for impairment in accordance with

IAS 36 ‘Impairment of Assets’ when there are indications that the carrying

value may not be recoverable.

Borrowing costs

Borrowing costs directly attributable to the acquisition or construction of

qualifying assets are capitalised. Qualifying assets are those that necessarily

take a substantial period of time to prepare for their intended use. All other

borrowing costs are recognised in the Group Income Statement in the

period in which they occur.

Investment property

Investment property is property held to earn rental income and/or for

capital appreciation rather than for the purpose of Group operating

activities. Investment property assets are carried at cost less accumulated

depreciation and any recognised impairment in value. The depreciation

policies for investment property are consistent with those described for

owner-occupied property.

Leasing

Leases are classified as finance leases whenever the terms of the lease

transfer substantially all the risks and rewards of ownership to the lessee.

All other leases are classified as operating leases.

The Group as a lessor

Amounts due from lessees under finance leases are recorded as receivables

at the amount of the Group’s net investment in the leases. Finance lease

income is allocated to accounting periods so as to reflect a constant

periodic rate of return on the Group’s net investment in the lease.

Rental income from operating leases is recognised on a straight-line basis

over the term of the relevant lease.

The Group as a lessee

Assets held under finance leases are recognised as assets of the Group

at their fair value or, if lower, at the present value of the minimum lease

payments, each determined at the inception of the lease. The corresponding

liability is included in the Group Balance Sheet as a finance lease obligation.

Lease payments are apportioned between finance charges and reduction

of the lease obligations so as to achieve a constant rate of interest on the

remaining balance of the liability. Finance charges are charged to the

Group Income Statement.

Rentals payable under operating leases are charged to the Group Income

Statement on a straight-line basis over the term of the relevant lease.

Sale and leaseback

A sale and leaseback transaction is one where a vendor sells an asset and

immediately reacquires the use of that asset by entering into a lease with

the buyer. The accounting treatment of the sale and leaseback depends

upon the substance of the transaction (by applying the lease classification

principles described above) and whether or not the sale was made at the

asset’s fair value.

For sale and finance leasebacks, any apparent profit or loss from the

sale is deferred and amortised over the lease term. For sale and operating

leasebacks, generally the assets are sold at fair value, and accordingly the

profit or loss from the sale is recognised immediately.

Following initial recognition, the lease treatment is consistent with those

principles described above.

Note 1 Accounting policies continued