American Airlines 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

7. Financial Instruments and Risk Management

Fuel Price Risk Management As part of the Company's risk management program, it uses a variety of financial

instruments, primarily heating oil option and collar contracts, as cash flow hedges to mitigate commodity price

risk. The Company does not hold or issue derivative financial instruments for trading purposes. As of December

31, 2009, the Company had fuel derivative contracts outstanding covering 20 million barrels of jet fuel that will be

settled over the next 24 months. A deterioration of the Company’s liquidity position may negatively affect the

Company’s ability to hedge fuel in the future.

In accordance with U.S. GAAP, the Company assesses, both at the inception of each hedge and on an ongoing

basis, whether the derivatives that are used in its hedging transactions are highly effective in offsetting changes in

cash flows of the hedged items. Derivatives that meet the requirements are granted special hedge accounting

treatment, and the Company’s hedges generally meet these requirements. Accordingly, the Company’s fuel

derivative contracts are accounted for as cash flow hedges, and the fair value of the Company’s hedging

contracts is recorded in Current Assets or Current Liabilities in the accompanying consolidated balance sheets

until the underlying jet fuel is purchased. The Company determines the ineffective portion of its fuel hedge

contracts by comparing the cumulative change in the total value of the fuel hedge contract, or group of fuel hedge

contracts, to the cumulative change in a hypothetical jet fuel hedge. If the total cumulative change in value of the

fuel hedge contract more than offsets the total cumulative change in a hypothetical jet fuel hedge, the difference is

considered ineffective and is immediately recognized as a component of Aircraft fuel expense. Effective gains or

losses on fuel hedging contracts are deferred in Accumulated other comprehensive income (loss) and are

recognized in earnings as a component of Aircraft fuel expense when the underlying jet fuel being hedged is

used.

Ineffectiveness is inherent in hedging jet fuel with derivative positions based in crude oil or other crude oil related

commodities. In assessing effectiveness, the Company uses a regression model to determine the correlation of

the change in prices of the commodities used to hedge jet fuel (e.g., NYMEX Heating oil) to the change in the

price of jet fuel. The Company also monitors the actual dollar offset of the hedges’ market values as compared to

hypothetical jet fuel hedges. The fuel hedge contracts are generally deemed to be ―highly effective‖ if the R-

squared is greater than 80 percent and dollar offset correlation is within 80 percent to 125 percent. The Company

discontinues hedge accounting prospectively if it determines that a derivative is no longer expected to be highly

effective as a hedge or if it decides to discontinue the hedging relationship. Subsequently, any changes in the fair

value of these derivatives are marked to market through earnings in the period of change.

For the years ended December 31, 2009, 2008 and 2007, the Company recognized net gains (losses) of

approximately ($651) million, $380 million and $239 million, respectively, as a component of Aircraft fuel expense

on the accompanying consolidated statements of operations related to its fuel hedging agreements, including the

ineffective portion of the hedges. The fair value of the Company’s fuel hedging agreements at December 31,

2009 and 2008, representing the amount the Company would receive (pay) upon termination of the agreements,

totaled $57 million and ($450) million, respectively, which excludes a payable for both years related to contracts

that settled in December of each year. As of December 31, 2009, the Company estimates that during the next

twelve months it will reclassify from Accumulated other comprehensive loss into earnings approximately $74

million in net losses (based on prices as of December 31, 2009) related to its fuel derivative hedges, including

losses from terminated contracts with a bankrupt counterparty in 2008.

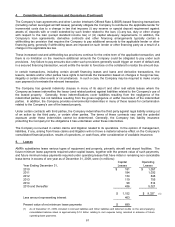

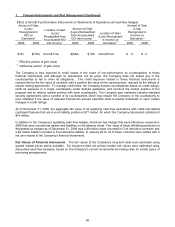

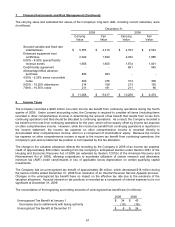

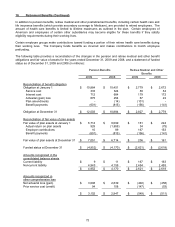

The impact of cash flow hedges on the Company’s consolidated financial statements for the years ending

December 31, 2009 and 2008, respectively, is depicted below (in millions):

Fair Value of Aircraft Fuel Derivative Instruments (all cash flow hedges)

Asset Derivatives as of December 31,

Liability Derivatives as of December 31,

2009

2008

2009

2008

Balance

Sheet

Location

Fair

Value

Balance

Sheet

Location

Fair

Value

Balance

Sheet

Location

Fair

Value

Balance

Sheet

Location

Fair

Value

Fuel

derivative

contracts

$ 126

Fuel

derivative

contracts

$ -

Fuel

derivative

liability

$ 71

Fuel

derivative

liability

$ 528