Lowe's 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Lowe's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Part II

Item 5 - Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities

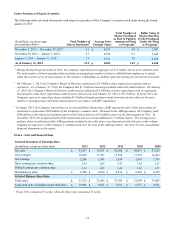

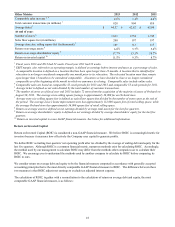

Lowe's common stock is traded on the New York Stock Exchange (NYSE). The ticker symbol for Lowe's is “LOW”. As of

March 28, 2014, there were 25,932 holders of record of Lowe's common stock. The following table sets forth, for the periods

indicated, the high and low sales prices per share of the common stock as reported by the NYSE Composite Tape and the

dividends per share declared on the common stock during such periods.

Fiscal 2013

Fiscal 2012

High

Low

Dividend

High

Low

Dividend

1st Quarter

$

39.98

$

35.86

$

0.16

$

32.29

$

26.58

$

0.14

2nd Quarter

45.30

38.87

0.18

31.37

24.76

0.16

3rd Quarter

50.74

43.52

0.18

33.63

25.34

0.16

4th Quarter

$

52.08

$

45.62

$

0.18

$

39.26

$

31.23

$

0.16

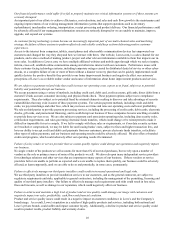

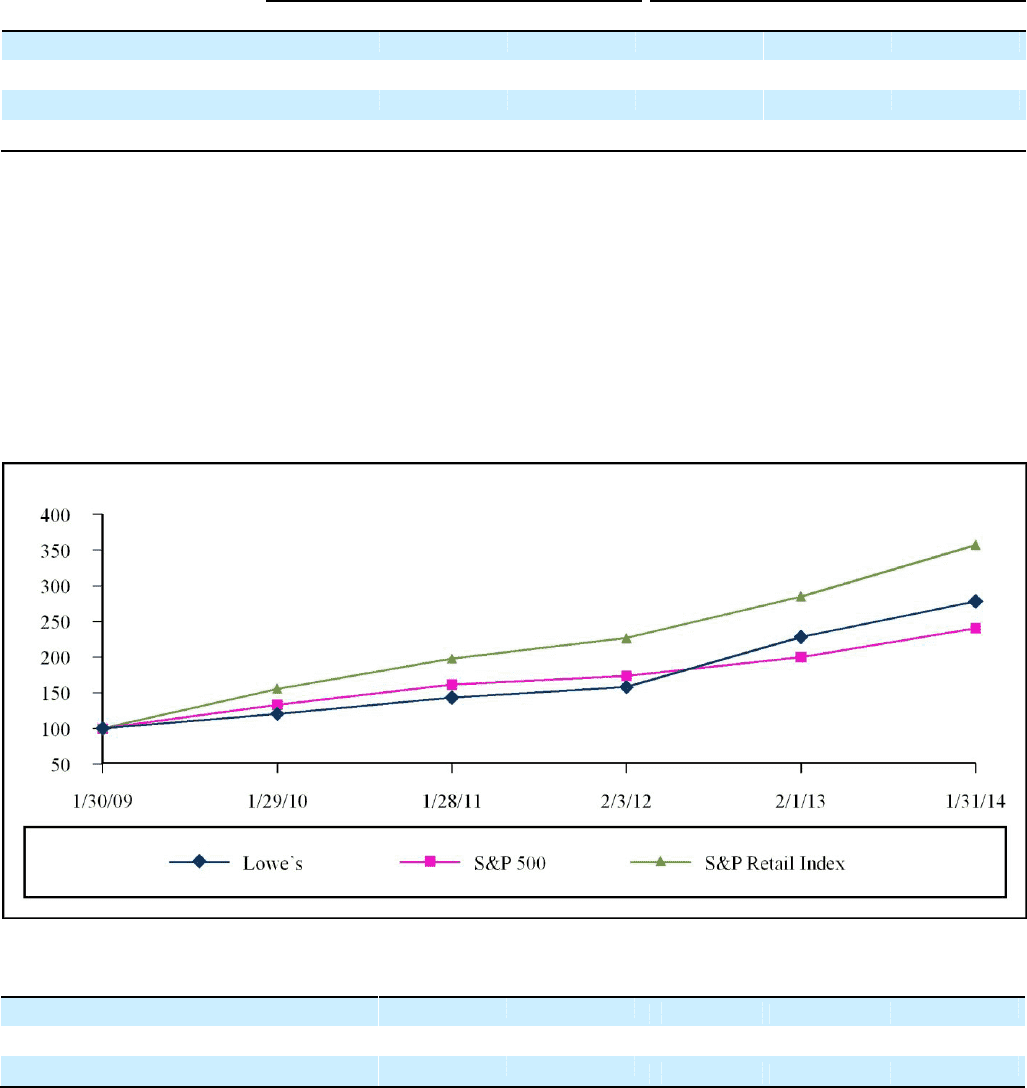

Total Return to Shareholders

The following information in Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be

“filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of

Section 18 of the Securities Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filing under

the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by

reference into such a filing.

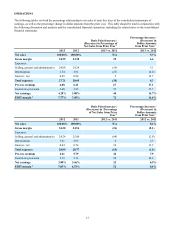

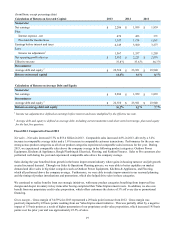

The following table and graph compare the total returns (assuming reinvestment of dividends) of the Company's common

stock, the S&P 500 Index and the S&P Retailing Industry Group Index (S&P Retail Index). The graph assumes $100 invested

on January 30, 2009 in the Company's common stock and each of the indices.

1/30/2009

1/29/2010

1/28/2011

2/3/2012

2/1/2013

1/31/2014

Lowe’s

$

100.00

$

120.52

$

143.18

$

157.72

$

228.08

$

278.16

S&P 500

100.00

133.14

161.44

173.80

199.98

240.58

S&P Retail Index

$

100.00

$

155.54

$

197.80

$

226.49

$

285.12

$

357.28