Yahoo 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the service period of the award. Stock-based awards granted on or after January 1, 2006 are valued based on the

grant date fair value of these awards; the Company records stock-based compensation expense on a straight-line

basis over the requisite service period, generally one to four years.

Calculating stock-based compensation expense requires the input of highly subjective assumptions, including the

expected term of the stock options, stock price volatility, and the pre-vesting forfeiture rate of stock awards. The

Company estimates the expected life of options granted based on historical exercise patterns, which the Company

believes are representative of future behavior. The Company estimates the volatility of its common stock on the

date of grant based on the implied volatility of publicly traded options on its common stock, with a term of one

year or greater. The Company believes that implied volatility calculated based on actively traded options on its

common stock is a better indicator of expected volatility and future stock price trends than historical volatility.

The assumptions used in calculating the fair value of stock-based awards represent the Company’s best estimates,

but these estimates involve inherent uncertainties and the application of management judgment. As a result, if

factors change and the Company uses different assumptions, the Company’s stock-based compensation expense

could be materially different in the future. In addition, the Company is required to estimate the expected

pre-vesting award forfeiture rate, as well as the probability that performance conditions that affect the vesting of

certain awards will be achieved, and only recognize expense for those shares expected to vest. The Company

estimates the forfeiture rate based on historical experience of the Company’s stock-based awards that are granted

and cancelled before vesting. If the Company’s actual forfeiture rate is materially different from the Company’s

original estimate, the stock-based compensation expense could be significantly different from what the Company

has recorded in the current period. Changes in the estimated forfeiture rate can have a significant effect on

reported stock-based compensation expense, as the effect of adjusting the forfeiture rate for all current and

previously recognized expense for unvested awards is recognized in the period the forfeiture estimate is changed.

If the actual forfeiture rate is higher than the estimated forfeiture rate, then an adjustment will be made to

increase the estimated forfeiture rate, which will result in a decrease to the expense recognized in the financial

statements. If the actual forfeiture rate is lower than the estimated forfeiture rate, then an adjustment will be

made to lower the estimated forfeiture rate, which will result in an increase to the expense recognized in the

financial statements. See Note 11—“Employee Benefits” for additional information.

The Company uses the “with and without” approach in determining the order in which tax attributes are utilized.

As a result, the Company only recognizes a tax benefit from stock-based awards in additional paid-in capital if an

incremental tax benefit is realized after all other tax attributes currently available to the Company have been

utilized. In addition, the Company accounts for the indirect effects of stock-based awards on other tax attributes,

such as the research tax credit, through the statement of income.

Operating and Capital Leases. The Company leases office space and data centers under operating leases and

certain data center equipment under a capital lease agreement with original lease periods up to 13 years. Assets

acquired under capital leases are amortized over the shorter of the remaining lease term or its estimated useful

life which is generally 10 to 15 years. Certain of the lease agreements contain rent holidays and rent escalation

provisions. For purposes of recognizing these lease incentives on a straight-line basis over the term of the lease,

the Company uses the date of initial possession to begin amortization. Lease renewal periods are considered on a

lease-by-lease basis and are generally not included in the period of straight-line recognition. For the year ended

December 31, 2008, the Company expensed $3 million of interest; for each of the years ended December 31,

2009 and December 31, 2010, the Company expensed $5 million of interest. As of December 31, 2009 and 2010,

the Company had a net lease commitment included in capital lease and other long-term liabilities in the

consolidated balance sheets of $43 million and $40 million, respectively.

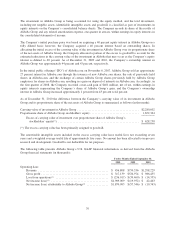

Income Taxes. Deferred income taxes are determined based on the differences between the financial reporting

and tax bases of assets and liabilities and are measured using the currently enacted tax rates and laws. The

Company records a valuation allowance against particular deferred income tax assets if it is more likely than not

that those assets will not be realized. The provision for income taxes comprises the Company’s current tax

liability and change in deferred income tax assets and liabilities.

68