Yahoo 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 31, 2009, the Company recognized a gain of $42 million, net of tax, in connection with the sale of its

investment in Gmarket. During the year ended December 31, 2010, gross realized gains and losses on

available-for-sale debt and equity securities were not material.

Concentration of Risk. Financial instruments that potentially subject the Company to significant concentration of

credit risk consist primarily of cash, cash equivalents, marketable debt securities, and accounts receivable. The

primary focus of the Company’s investment strategy is to preserve capital and meet liquidity requirements. A

large portion of the Company’s cash is managed by external managers within the guidelines of the Company’s

investment policy. The Company’s investment policy addresses the level of credit exposure by limiting the

concentration in any one corporate issuer or sector and establishing a minimum allowable credit rating. To

manage the risk exposure, the Company maintains its portfolio of cash and cash equivalents and short-term and

long-term investments in a variety of fixed income securities, including government, municipal and highly rated

corporate debt obligations and money market funds. Accounts receivable are typically unsecured and are derived

from revenue earned from customers. The Company performs ongoing credit evaluations of its customers and

maintains allowances for potential credit losses. Historically, such losses have been within management’s

expectations. As of December 31, 2009 and 2010, no one customer accounted for 10 percent or more of the

accounts receivable balance and no one customer accounted for 10 percent or more of the Company’s revenue for

2008, 2009, or 2010.

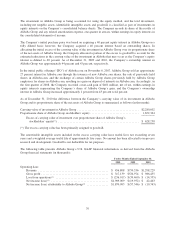

Property and Equipment. Buildings are stated at cost and depreciated using the straight-line method over the

estimated useful lives of 25 years. Leasehold improvements are amortized over the lesser of their expected useful

lives and the remaining lease term. Computers and equipment and furniture and fixtures are stated at cost and

depreciated using the straight-line method over the estimated useful lives of the assets, generally two to five

years.

Property and equipment to be held and used are reviewed for impairment whenever events or changes in

circumstances indicate that the carrying value of the assets may not be recoverable. Determination of

recoverability is based on the lowest level of identifiable estimated undiscounted future cash flows resulting from

the use of the asset and its eventual disposition. Measurement of any impairment loss for long-lived assets that

management expects to hold and use is based on the excess of the carrying value of the asset over its fair value.

No impairments of such assets were identified during any of the periods presented.

Internal Use Software and Website Development Costs. The Company capitalized certain internal use software

and Website development costs totaling approximately $149 million, $90 million, and $110 million during 2008,

2009, and 2010, respectively. The estimated useful life of costs capitalized is evaluated for each specific project

and ranges from one to three years. During 2008, 2009, and 2010, the amortization of capitalized costs totaled

approximately $81 million, $128 million, and $108 million, respectively. Capitalized internal use software and

Website development costs are included in property and equipment, net. Included in the capitalized amounts

above are $22 million, $14 million, and $16 million, respectively, of stock-based compensation expense in the

years ended December 31, 2008, 2009, and 2010.

Goodwill. Goodwill represents the excess of the purchase price over the fair value of the net tangible and

intangible assets acquired in a business combination. Goodwill is not amortized, but is tested for impairment on

an annual basis and between annual tests in certain circumstances. The performance of the goodwill impairment

test involves a two-step process. The first step involves comparing the fair value of the Company’s reporting

units to their carrying values, including goodwill. The Company’s reporting units are based on geography, either

at the operating segment level or one level below operating segments. The fair values of the reporting units are

estimated using an average of a market approach and an income approach as this combination is deemed to be the

most indicative of the Company’s fair value in an orderly transaction between market participants. In addition,

the fair values estimated under these two approaches are validated against each other to ensure consistency.

Under the market approach, the Company utilizes publicly-traded comparable company information, specific to

the regions in which the reporting units operate, to determine revenue and earnings multiples that are used to

value the reporting units adjusted for an estimated control premium. Under the income approach, the Company

70