eTrade 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253

|

|

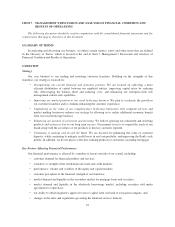

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and the

related notes that appear elsewhere in this document.

GLOSSARY OF TERMS

In analyzing and discussing our business, we utilize certain metrics, ratios and other terms that are defined

in the Glossary of Terms, which is located at the end of Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations.

OVERVIEW

Strategy

Our core business is our trading and investing customer franchise. Building on the strengths of this

franchise, our strategy is focused on:

•Strengthening our overall financial and franchise position. We are focused on achieving a more

efficient distribution of capital between our regulated entities, improving capital ratios by reducing

risk, deleveraging the balance sheet and reducing costs, and enhancing our enterprise-wide risk

management culture and capabilities.

•Improving our market position in our retail brokerage business. We plan to accelerate the growth in

our customer franchise and to continue enhancing the customer experience.

•Capitalizing on the value of our complementary brokerage businesses. Our corporate services and

market making businesses enhance our strategy by allowing us to realize additional economic benefit

from our retail brokerage business.

•Enhancing our position in retirement and investing. We believe growing our retirement and investing

products and services is key to our long term success. Our primary focus is to expand the reach of our

brand along with the awareness of our products to this key customer segment.

•Continuing to manage and de-risk the Bank. We are focused on optimizing the value of customer

deposits, while continuing to mitigate credit losses in our loan portfolio, and improving the Bank’s risk

profile. In addition, we do not plan to offer new banking products to customers, including mortgages.

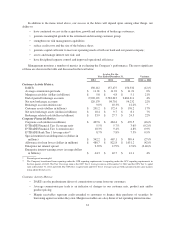

Key Factors Affecting Financial Performance

Our financial performance is affected by a number of factors outside of our control, including:

• customer demand for financial products and services;

• weakness or strength of the residential real estate and credit markets;

• performance, volume and volatility of the equity and capital markets;

• customer perception of the financial strength of our franchise;

• market demand and liquidity in the secondary market for mortgage loans and securities;

• market demand and liquidity in the wholesale borrowings market, including securities sold under

agreements to repurchase;

• our ability to obtain regulatory approval to move capital from our bank to our parent company; and

• changes to the rules and regulations governing the financial services industry.

32