Windstream 2007 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2007 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

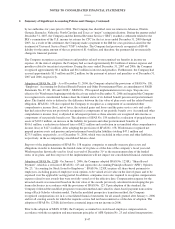

5. Debt:

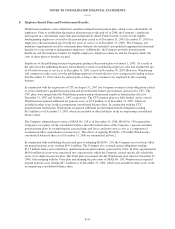

Long-term debt was as follows at December 31:

(Millions) 2007 2006

Issued by Windstream Corporation:

Senior secured credit facility, Tranche A – variable rates, due July 17, 2011 (a) $ 283.3 $ 500.0

Senior secured credit facility, Tranche B – variable rates, due July 17, 2013 (b) 1,393.0 1,900.0

Senior secured credit facility, Revolving line of credit - variable rates, due

July 17, 2011 (c) 100.0 -

Debentures and notes, without collateral:

2016 Notes – 8.625%, due August 1, 2016 (e) 1,746.0 1,746.0

2013 Notes – 8.125%, due August 1, 2013 (e) 800.0 800.0

2019 Notes – 7.000%, due March 15, 2019 (b) (e) 500.0 -

Issued by subsidiaries of the Company:

Valor Telecommunications Enterprises LLC and Valor Telecommunications

Finance Corp. – 7.75%, due February 15, 2015 (d) (e) 400.0 400.0

Windstream Holdings of the Midwest, Inc. - 6.75%, due April 1, 2028 (d) (e) 100.0 100.0

Debentures and notes, without collateral:

Windstream Georgia Communications Corp. – 6.50%, due November 15,

2013 60.0 70.0

Teleview, Inc. – 7.00%, due January 2, 2010 and May 2, 2010 0.6 0.8

Discount on long-term debt, net of premiums (27.4) (28.4)

5,355.5 5,488.4

Less current maturities (24.3) (32.2)

Total long-term debt $ 5,331.2 $ 5,456.2

Weighted average interest rate 7.7% 7.8%

Weighted maturity 7.4 years 7.8 years

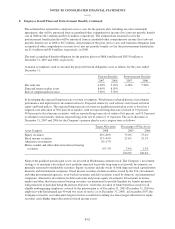

(a) Pursuant to the sale of its publishing business in November 2007, the Company retired $210.5 million of

Tranche A senior secured debt under its credit facility in a debt-for-debt exchange (Note 3).

(b) In February 2007, Windstream issued $500.0 million aggregate principal amount of senior notes due 2019,

with an interest rate of 7.0 percent, and used the net proceeds of the offering to repay $500.0 million of

amounts outstanding under the term loan portion of its senior secured credit facilities (“the refinancing

transaction”). Additionally, Windstream received the consent of lenders to an amendment and restatement of

its $2.9 billion senior secured credit facilities. Windstream amended and restated its senior secured credit

facilities to, among other things, reduce the interest payable under Tranche B of the term loan portion of the

facilities; modify the pre-payment provision; and modify certain covenants to permit the consummation of

the split off of its directory publishing business.

(c) During the third quarter of 2007, the Company borrowed $250.0 million from the revolving line of credit in

its senior secured credit facilities in order to finance a portion of the cost of the acquisition of CTC. The

Company used cash flows from operations to pay down a portion of these borrowings during the fourth

quarter of 2007, and currently has $100.0 million remaining outstanding at December 31, 2007, which is

included in long-term debt in the accompanying consolidated balance sheet. The revolving line of credit’s

variable interest rates ranged from 5.92 percent to 6.76 percent and the weighted average rate was 6.25

percent during 2007.

(d) The Company’s collateralized Valor debt is equally and ratably secured with debt under the senior secured

credit facilities. Debt held by Windstream Holdings of the Midwest, Inc., a subsidiary of the Company, is

secured solely by the assets of the subsidiary.

(e) Certain of the Company’s debentures and notes are callable at various premiums on early redemption.

Windstream has a five-year $500.0 million unsecured line of credit under a revolving credit agreement with an

expiration date of July 17, 2011. Letters of credit are deducted in determining the total amount available for

F-56