American Airlines 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

11. Goodwill and Other Intangible Assets

Effective January 1, 2002, the Company adopted Statement of Financial Accounting Standards No. 142, “Goodwill

and Other Intangible Assets” (SFAS 142). SFAS 142 requires the Company to test goodwill and indefinite-lived

intangible assets (for AMR, route acquisition costs) for impairment rather than amortize them. In so doing, the

Company determined its entire goodwill balance of $1.4 billion was impaired. In arriving at this conclusion, the

Company’s net book value was determined to be in excess of the Company’s fair value at January 1, 2002, using

AMR as the reporting unit for purposes of the fair value determination. The Company determined its fair value as

of January 1, 2002 using market capitalization as the primary indicator of fair value. As a result, the Company

recorded a one-time, non-cash charge, effective January 1, 2002, of $988 million ($6.35 per share, net of a tax

benefit of $363 million) to write-off all of AMR’s goodwill. The tax benefit of $363 million differed from the amount

computed at the statutory federal income tax rate due to a portion of AMR’s goodwill not being deductible for

federal tax purposes. The charge is nonoperational in nature and is reflected as a cumulative effect of accounting

change in the accompanying consolidated statements of operations.

The pro forma effect of discontinuing amortization of goodwill and route acquisition costs under SFAS 142 -

assuming the Company had adopted this standard as of January 1, 2001 – results in an adjusted net loss of

approximately $1,722 million, or $11.17 per share for the year ended December 31, 2001.

The Company had route acquisition costs (including international slots) of $829 million as of December 31, 2003

and 2002. The Company’s impairment analysis for route acquisition costs did not result in an impairment charge in

2003 or 2002.

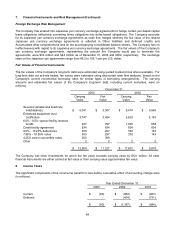

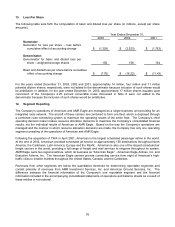

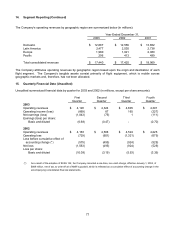

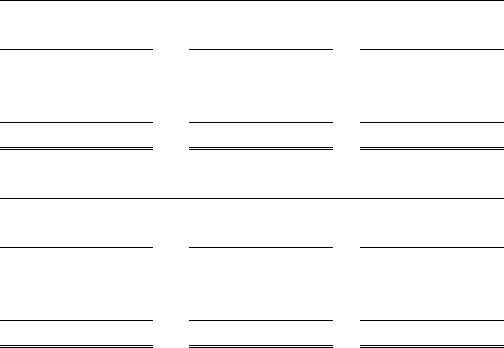

The following tables provide information relating to the Company’s amortized intangible assets as of December 31

(in millions):

2003

Cost

Accumulated

Amortization

Net Book

Value

Amortized intangible assets:

Airport operating rights $ 517 $ 199 $ 318

Gate lease rights 191 85 106

Total $ 708 $ 284 $ 424

2002

Cost

Accumulated

Amortization

Net Book

Value

Amortized intangible assets:

Airport operating rights $ 516 $ 178 $ 338

Gate lease rights 204 79 125

Total $ 720 $ 257 $ 463

Airport operating and gate lease rights are being amortized on a straight-line basis over 25 years to a zero residual

value. The Company recorded amortization expense related to these intangible assets of approximately $28

million for each of the years ended December 31, 2003 and 2002 and $29 million for the year ended December 31,

2001. The Company expects to record annual amortization expense of approximately $28 million in each of the

next five years related to these intangible assets.