Yahoo 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yahoo! Inc.

Notes to Consolidated Financial Statements—(Continued)

The total purchase price of $255 million consisted of $245 million in cash consideration, $8 million in equity

assumed/exchanged, and $2 million of direct transaction costs. The $245 million of total cash consideration less

cash acquired of $10 million resulted in a net cash outlay of $235 million. In connection with the acquisition, the

Company issued stock-based awards valued at $47 million which is being recognized as stock-based

compensation expense as the awards vest over a period of up to four years.

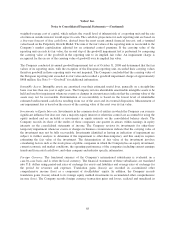

The allocation of the purchase price of the assets acquired and liabilities assumed based on their fair values was

as follows (in thousands):

Cash acquired ...................................................................... $ 10,235

Other tangible assets acquired ......................................................... 13,416

Amortizable intangible assets:

Customer contracts and related relationships .......................................... 30,300

Developed technology and patents .................................................. 11,000

Trade name, trademark, and domain name ........................................... 100

In-process research and development ............................................... 200

Goodwill .......................................................................... 224,385

Total assets acquired ............................................................ 289,636

Liabilities assumed .................................................................. (17,947)

Deferred income taxes ............................................................... (16,640)

Total ......................................................................... $255,049

The amortizable intangible assets have useful lives not exceeding six years and a weighted average useful life of

five years. The Company allocated $224 million to goodwill. Goodwill represents the excess of the purchase

price over the fair value of the net tangible and intangible assets acquired and is not deductible for tax purposes.

The goodwill recorded in connection with this acquisition is included in the U.S. ($142 million) and International

($82 million) segments.

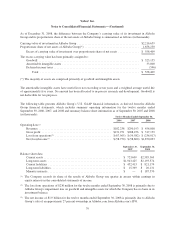

Other Acquisitions—Business Combinations. During the year ended December 31, 2007, the Company acquired

two other companies which were accounted for as business combinations. The total purchase price for these

acquisitions was $108 million and consisted of $106 million in cash consideration and $2 million of direct

transaction costs. The total cash consideration of $106 million less cash acquired of $5 million resulted in a net

cash outlay of $101 million. Of the purchase price, $74 million was allocated to goodwill, $33 million to

amortizable intangible assets, $5 million to tangible assets, $5 million to cash acquired, and $9 million to net

assumed liabilities. Goodwill represents the excess of the purchase price over the fair value of the net tangible

and intangible assets acquired and is not deductible for tax purposes.

Other Acquisitions—Asset Acquisitions. During the year ended December 31, 2007, the Company acquired five

companies which were accounted for as asset acquisitions. The total purchase price for these acquisitions was

$61 million and consisted of $23 million in cash consideration, $35 million in equity consideration, $2 million of

assumed liabilities, and $1 million of direct transaction costs. The total cash consideration of $23 million less

cash acquired of $3 million resulted in a net cash outlay of $20 million. For accounting purposes, approximately

$85 million was allocated to amortizable intangible assets, $29 million to net assumed liabilities, primarily

deferred income tax liabilities, $2 million to tangible assets, and $3 million to cash acquired. In connection with

these acquisitions, the Company also issued stock-based awards valued at $19 million that will be recognized as

stock-based compensation expense over the next three years.

75