American Airlines 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

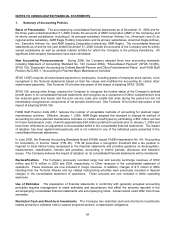

4. Commitments, Contingencies and Guarantees

As of December 31, 2006, the Company had commitments to acquire an aggregate of 47 Boeing 737-800s and

seven Boeing 777-200ERs in 2013 through 2016. Future payments for all aircraft, including the estimated

amounts for price escalation, will be approximately $2.8 billion in 2011 through 2016.

American has granted Boeing a security interest in American’s purchase deposits with Boeing. These purchase

deposits totaled $177 million and $277 million at December 31, 2006 and 2005, respectively.

The Company has contracts related to facility construction or improvement projects, primarily at airport locations.

The contractual obligations related to these projects totaled approximately $124 million as of December 31, 2006.

The Company expects to make payments of $114 million and $8 million in 2007 and 2008, respectively. See

Footnote 6 for information related to financing of JFK construction costs which are included in these amounts. In

addition, the Company has an information technology support related contract that requires minimum annual

payments of $152 million through 2013.

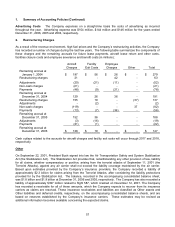

American has capacity purchase agreements with two regional airlines, Chautauqua Airlines, Inc. (Chautauqua)

and Trans States Airlines, Inc. (collectively the American Connection® carriers) to provide Embraer EMB-140/145

regional jet services to certain markets under the brand “American Connection”. Under these arrangements, the

Company pays the American Connection carriers a fee per block hour to operate the aircraft. The block hour fees

are designed to cover the American Connection carriers’ fully allocated costs plus a margin. Assumptions for

certain costs such as fuel, landing fees, insurance, and aircraft ownership are trued up to actual values on a pass

through basis. In consideration for these payments, the Company retains all passenger and other revenues

resulting from the operation of the American Connection regional jets. Minimum payments under the contracts

are $97 million in 2007, $66 million in 2008 and $16 million in 2009. In addition, if the Company terminates the

Chautauqua contract without cause, Chautauqua has the right to put its 15 Embraer aircraft to the Company. If

this were to happen, the Company would take possession of the aircraft and become liable for lease obligations

totaling approximately $21 million per year with lease expirations in 2018 and 2019.

The Company is a party to many routine contracts in which it provides general indemnities in the normal course of

business to third parties for various risks. The Company is not able to estimate the potential amount of any liability

resulting from the indemnities. These indemnities are discussed in the following paragraphs.

The Company’s loan agreements and other London Interbank Offered Rate (LIBOR)-based financing transactions

(including certain leveraged aircraft leases) generally obligate the Company to reimburse the applicable lender for

incremental costs due to a change in law that imposes (i) any reserve or special deposit requirement against

assets of, deposits with, or credit extended by such lender related to the loan, (ii) any tax, duty, or other charge

with respect to the loan (except standard income tax) or (iii) capital adequacy requirements. In addition, the

Company’s loan agreements, derivative contracts and other financing arrangements typically contain a

withholding tax provision that requires the Company to pay additional amounts to the applicable lender or other

financing party, generally if withholding taxes are imposed on such lender or other financing party as a result of a

change in the applicable tax law.

These increased cost and withholding tax provisions continue for the entire term of the applicable transaction, and

there is no limitation on the maximum additional amounts the Company could be obligated to pay under such

provisions. Any failure to pay amounts due under such provisions generally would trigger an event of default, and,

in a secured financing transaction, would entitle the lender to foreclose upon the collateral to realize the amount

due.