American Airlines 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

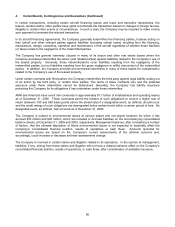

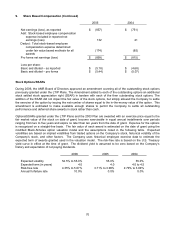

5. Leases

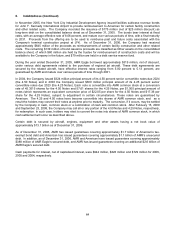

AMR's subsidiaries lease various types of equipment and property, primarily aircraft and airport facilities. The

future minimum lease payments required under capital leases, together with the present value of such payments,

and future minimum lease payments required under operating leases that have initial or remaining non-

cancelable lease terms in excess of one year as of December 31, 2006, were (in millions):

Year Ending December 31,

Capital

Leases

Operating

Leases

2007 $ 197 $ 1,098

2008 236 1,032

2009 175 929

2010 140 860

2011 142 855

2012 and thereafter 651 6,710

1,541 $ 11,484

(1)

Less amount representing interest 614

Present value of net minimum lease payments $ 927

(1) As of December 31, 2006, included in Accrued liabilities and Other liabilities and deferred credits on the accompanying

consolidated balance sheet is approximately $1.4 billion relating to rent expense being recorded in advance of future

operating lease payments.

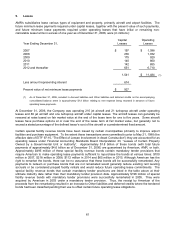

At December 31, 2006, the Company was operating 210 jet aircraft and 21 turboprop aircraft under operating

leases and 89 jet aircraft and one turboprop aircraft under capital leases. The aircraft leases can generally be

renewed at rates based on fair market value at the end of the lease term for one to five years. Some aircraft

leases have purchase options at or near the end of the lease term at fair market value, but generally not to

exceed a stated percentage of the defined lessor's cost of the aircraft or a predetermined fixed amount.

Certain special facility revenue bonds have been issued by certain municipalities primarily to improve airport

facilities and purchase equipment. To the extent these transactions were committed to prior to May 21, 1998 (the

effective date of EITF 97-10, “The Effect of Lessee Involvement in Asset Construction”) they are accounted for as

operating leases under Financial Accounting Standards Board Interpretation 23, “Leases of Certain Property

Owned by a Governmental Unit or Authority”. Approximately $1.8 billion of these bonds (with total future

payments of approximately $4.6 billion as of December 31, 2006) are guaranteed by American, AMR, or both.

Approximately $495 million of these special facility revenue bonds contain mandatory tender provisions that

require American to make operating lease payments sufficient to repurchase the bonds at various times: $100

million in 2007, $218 million in 2008, $112 million in 2014 and $65 million in 2015. Although American has the

right to remarket the bonds, there can be no assurance that these bonds will be successfully remarketed. Any

payments to redeem or purchase bonds that are not remarketed would generally reduce existing rent leveling

accruals or be considered prepaid facility rentals and would reduce future operating lease commitments. The

special facility revenue bonds that contain mandatory tender provisions are listed in the table above at their

ultimate maturity date rather than their mandatory tender provision date. Approximately $198 million of special

facility revenue bonds with mandatory tender provisions were successfully remarketed in 2005. They were

acquired by American in 2003 under a mandatory tender provision. Thus, the receipt by American of the

proceeds from the remarketing resulted in an increase to Other liabilities and deferred credits where the tendered

bonds had been classified pending their use to offset certain future operating lease obligations.