American Airlines 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

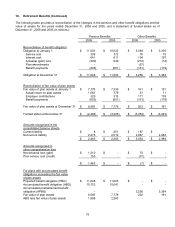

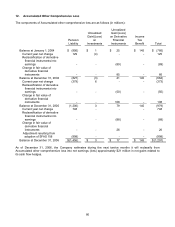

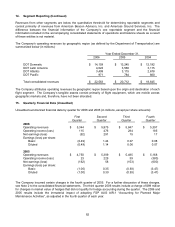

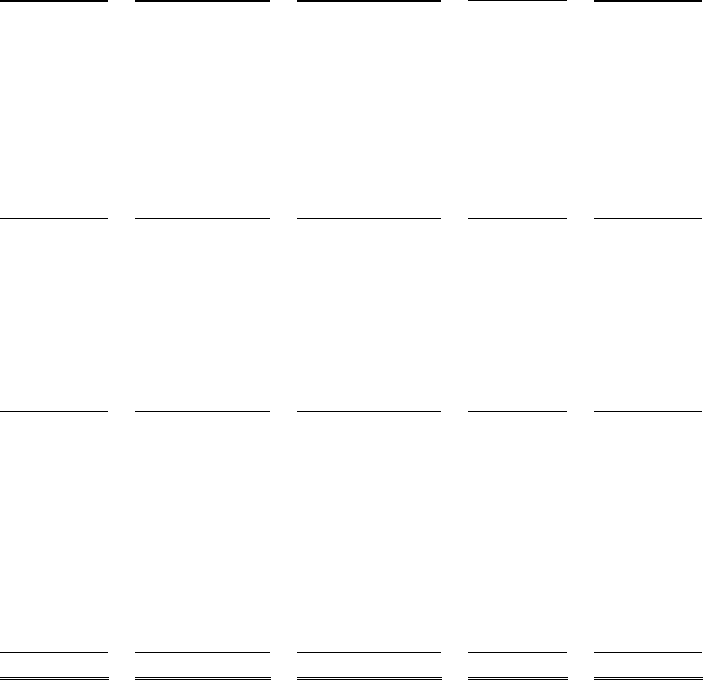

12. Accumulated Other Comprehensive Loss

The components of Accumulated other comprehensive loss are as follows (in millions):

Pension

Liability

Unrealized

Gain/(Loss)

on

Investments

Unrealized

Gain/(Loss)

on Derivative

Financial

Instruments

Income

Tax

Benefit

Total

Balance at January 1, 2004 $ (956) $ 1 $ 25 $ 145 $ (785)

Current year net change 129 (4) - - 125

Reclassification of derivative

financial instruments into

earnings

-

-

(89)

-

(89)

Change in fair value of

derivative financial

instruments

-

-

85

-

85

Balance at December 31, 2004 (827) (3) 21 145 (664)

Current year net change (379) 6 - - (373)

Reclassification of derivative

financial instruments into

earnings

-

-

(50)

-

(50)

Change in fair value of

derivative financial

instruments

-

-

108

-

108

Balance at December 31, 2005 (1,206) 3 79 145 (979)

Current year net change 748 - - - 748

Reclassification of derivative

financial instruments into

earnings

-

-

(88)

-

(88)

Change in fair value of

derivative financial

instruments

-

-

26

-

26

Adjustment resulting from

adoption of SFAS 158

(998)

-

-

-

(998)

Balance at December 31, 2006 $ (1,456) $ 3 $ 17 $ 145 $ (1,291)

As of December 31, 2006, the Company estimates during the next twelve months it will reclassify from

Accumulated other comprehensive loss into net earnings (loss) approximately $21 million in net gains related to

its cash flow hedges.