American Airlines 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

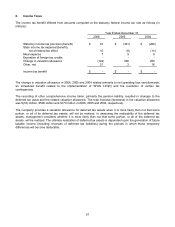

6. Indebtedness (Continued)

The Term Loan Facility matures on December 17, 2010 and amortizes quarterly at a rate of $1 million. Principal

amounts repaid under the Term Loan Facility may not be re-borrowed.

The Credit Facility is secured by certain aircraft. The Credit Facility includes a covenant that requires periodic

appraisal of the aircraft at current market value and requires American to pledge more aircraft or cash collateral if

the loan amount is more than 50 percent of the appraised value (after giving effect to sublimits for specified

categories of aircraft). In addition, the Credit Facility is secured by all of American’s existing route authorities

between the United States and Tokyo, Japan, together with certain slots, gates and facilities that support the

operation of such routes. American’s obligations under the Credit Facility are guaranteed by AMR, and AMR’s

guaranty is secured by a pledge of all the outstanding shares of common stock of American.

The Credit Facility contains a covenant (the Liquidity Covenant) requiring American to maintain, as defined,

unrestricted cash, unencumbered short term investments and amounts available for drawing under committed

revolving credit facilities which have a final maturity of at least 12 months after the date of determination, of not

less than $1.25 billion for each quarterly period through the remaining life of the Credit Facility.

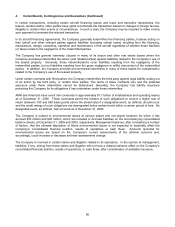

In addition, the Credit Facility contains a covenant (the EBITDAR Covenant) requiring AMR to maintain a ratio of

cash flow (defined as consolidated net income, before interest expense (less capitalized interest), income taxes,

depreciation and amortization and rentals, adjusted for certain gains or losses and non-cash items) to fixed

charges (comprising interest expense (less capitalized interest) and rentals) of at least the amount specified

below for each period of four consecutive quarters ending on the dates set forth below:

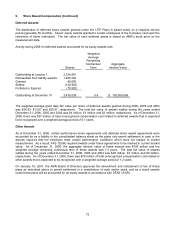

Four Quarter Period Ending Cash Flow Coverage Ratio

March 31, 2007 1.30:1.00

June 30, 2007 1.30:1.00

September 30, 2007 1.35:1.00

December 31, 2007 1.40:1.00

March 31, 2008 1.40:1.00

June 30, 2008 1.40:1.00

September 30, 2008 1.40:1.00

December 31, 2008 1.40:1.00

March 31, 2009 1.40:1.00

June 30, 2009 (and each fiscal quarter

thereafter)

1.50:1.00

AMR and American were in compliance with the Liquidity Covenant and the EBITDAR Covenant at December 31,

2006 and expect to be able to comply with these covenants. However, given fuel prices that are high by historical

standards and the volatility of fuel prices and revenues, it is difficult to assess whether AMR and American will, in

fact, be able to continue to comply with the Liquidity Covenant and, in particular, the EBITDAR Covenant, and

there are no assurances that they will be able to do so. Failure to comply with these covenants would result in a

default under the Credit Facility which - - if the Company did not take steps to obtain a waiver of, or otherwise

mitigate, the default - - could result in a default under a significant amount of the Company’s other debt and lease

obligations and have a material adverse impact on the Company.

In September 2005, American sold and leased back 89 spare engines with a book value of $105 million to a

variable interest entity (VIE). The net proceeds received from third parties were $133 million. American is

considered the primary beneficiary of the activities of the VIE as American has substantially all of the residual

value risk associated with the transaction. As such, American is required to consolidate the VIE in its financial

statements. At December 31, 2006, the book value of the engines was $94 million and was included in Flight

equipment on the consolidated balance sheet. The engines serve as collateral for the VIE’s long-term debt of

$123 million at December 31, 2006, which has also been included in the consolidated balance sheet. The VIE

has no other significant operations.