Safeway 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Note K to the consolidated financial statements and include, among other things, the discount rate, the expected long-

term rate of return on plan assets and the rate of compensation increases. Actual results in any given year will often differ

from actuarial assumptions because of economic and other factors. In accordance with GAAP, the amount by which

actual results differ from the actuarial assumptions is accumulated and amortized over future periods and, therefore,

affects recognized expense and the recorded obligation in such future periods. While Safeway believes its assumptions

are appropriate, significant differences in actual results or significant changes in the Company’s assumptions may

materially affect Safeway’s pension and other postretirement obligations and its future expense.

Safeway bases the discount rate on current investment yields on high quality fixed-income investments. The discount rate

assumption used to determine the year-end projected benefit obligation is increased or decreased to be consistent with

the change in yield rates for high quality fixed-income investments for the expected period to maturity of the pension

benefits. The discount rate used to determine 2009 pension expense was 6.3%. A lower discount rate increases the

present value of benefit obligations and increases pension expense. Expected return on pension plan assets is based on

historical experience of the Company’s portfolio and the review of projected returns by asset class on broad, publicly

traded equity and fixed-income indices, as well as target asset allocation. Safeway’s target asset allocation mix is designed

to meet the Company’s long-term pension requirements. For 2009, the Company’s assumed rate of return was 8.5% on

U.S. pension assets and 7.0% on Canadian pension assets. Over the 10-year period ended January 2, 2010, the average

rate of return was approximately 3% for U.S. and 5% for Canadian pension assets. The deteriorating conditions in the

global financial markets during 2008 led to a substantial reduction in the 10-year average rate of return on pension

assets. We expect that the markets will eventually recover to our assumed long-term rate of return.

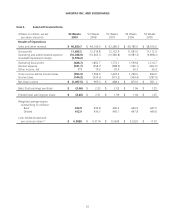

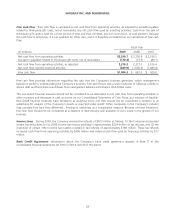

The following table summarizes actual allocations for Safeway’s plans at year-end:

Plan assets

Asset category Target 2009 2008

Equity 65% 68.9% 60.8%

Fixed income 35 30.3 38.0

Cash and other – 0.8 1.2

Total 100% 100.0%100.0%

The investment policy also emphasizes the following key objectives: (1) maintain a diversified portfolio among asset

classes and investment styles; (2) maintain an acceptable level of risk in pursuit of long-term economic benefit;

(3) maximize the opportunity for value-added returns from active investment management while establishing investment

guidelines and monitoring procedures for each investment manager to ensure the characteristics of the portfolio are

consistent with the original investment mandate; and (4) maintain adequate controls over administrative costs.

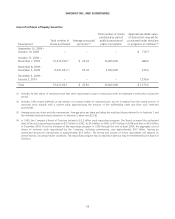

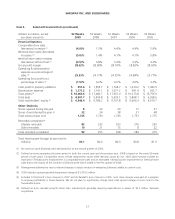

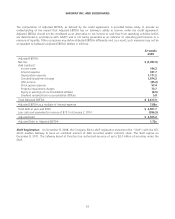

Sensitivity to changes in the major assumptions for Safeway’s pension plans are as follows (dollars in millions):

United States Canada

Percentage

point

change

Projected benefit

obligation

decrease

(increase)

Expense

decrease

(increase)

Projected benefit

obligation

decrease

(increase)

Expense

decrease

(increase)

Expected return on assets +/-1.0 pt _ $ 11.0/(11.0) _ $ 2.4/(2.5)

Discount rate +/-1.0 pt $ 203.8/(254.3) $ 22.0/(27.3) $ 47.8/(55.0) $ 4.0/(4.3)

Cash contributions, primarily in Canada, to the Company’s pension plans are expected to total approximately $7.8 million

in 2010 and totaled $16.7 million in 2009, $33.8 million in 2008 and $33.0 million in 2007.

25