Verizon Wireless 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Verizon Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

61

NOTE 12

EMPLOYEE BENEFITS

We maintain non-contributory dened benet pension plans for many

of our employees. In addition, we maintain postretirement health care

and life insurance plans for our retirees and their dependents, which

are both contributory and non-contributory, and include a limit on our

share of the cost for certain recent and future retirees. In accordance

with our accounting policy for pension and other postretirement ben-

ets, operating expenses include pension and benet related credits

and/or charges based on actuarial assumptions, including projected

discount rates and an estimated return on plan assets. These estimates

are updated in the fourth quarter to reect actual return on plan assets

and updated actuarial assumptions. The adjustment is recognized in the

income statement during the fourth quarter or upon a remeasurement

event pursuant to our accounting policy for the recognition of actuarial

gains and losses.

Pension and Other Postretirement Benets

Pension and other postretirement benets for many of our employees

are subject to collective bargaining agreements. Modications in bene-

ts have been bargained from time to time, and we may also periodically

amend the benefits in the management plans. The following tables

summarize benet costs, as well as the benet obligations, plan assets,

funded status and rate assumptions associated with pension and postre-

tirement health care and life insurance benet plans.

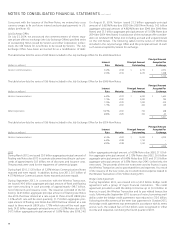

Obligations and Funded Status

(dollars in millions)

Pension Health Care and Life

At December 31, 2014 2013 2014 2013

Change in Benet

Obligations

Beginning of year $ 23,032 $ 26,773 $ 23,042 $ 26,844

Service cost 327 395 258 318

Interest cost 1,035 1,002 1,107 1,095

Plan amendments (89) (149) (412) (119)

Actuarial (gain) loss, net 2,977 (2,327) 4,645 (3,576)

Benets paid (1,566) (1,777) (1,543) (1,520)

Curtailment and termination

benets 11 4 – –

Settlements paid (407) (889) – –

End of year $ 25,320 $ 23,032 $ 27,097 $ 23,042

Change in Plan Assets

Beginning of year $ 17,111 $ 18,282 $ 3,053 $ 2,657

Actual return on plan assets 1,778 1,388 193 556

Company contributions 1,632 107 732 1,360

Benets paid (1,566) (1,777) (1,543) (1,520)

Settlements paid (407) (889) – –

End of year $ 18,548 $ 17,111 $ 2,435 $ 3,053

Funded Status

End of year $ (6,772) $ (5,921) $ (24,662) $ (19,989)

(dollars in millions)

Pension Health Care and Life

At December 31, 2014 2013 2014 2013

Amounts recognized on the

balance sheet

Noncurrent assets $ 337 $ 339 $ – $ –

Current liabilities (122) (137) (528) (710)

Noncurrent liabilities (6,987) (6,123) (24,134) (19,279)

Total $ (6,772) $ (5,921) $ (24,662) $ (19,989)

Amounts recognized in

Accumulated Other

Comprehensive Income

(Pre-tax)

Prior Service Benet (Cost) $ (56) $ 25 $ (2,280) $ (2,120)

Total $ (56) $ 25 $ (2,280) $ (2,120)

Beginning in 2013, as a result of federal health care reform, Verizon no

longer les for the Retiree Drug Subsidy (RDS) and instead contracts with

a Medicare Part D plan on a group basis to provide prescription drug

benets to Medicare eligible retirees.

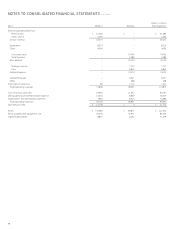

The accumulated benefit obligation for all defined benefit

pension plans was $25.3 billion and $22.9 billion at December 31, 2014

and 2013, respectively.

Information for pension plans with an accumulated benet obligation in

excess of plan assets follows:

(dollars in millions)

At December 31, 2014 2013

Projected benet obligation $ 24,919 $ 22,610

Accumulated benet obligation 24,851 22,492

Fair value of plan assets 17,810 16,350