Kohl's 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

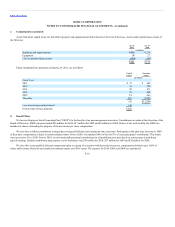

The following table illustrates the primary costs classified in Cost of Merchandise Sold and Selling, General and Administrative Expenses:

• Total cost of products sold including product development costs, net of

vendor payments other than reimbursement of specific, incremental and

identifiable costs

• Inventory shrink

• Markdowns

• Freight expenses associated with moving merchandise from our vendors to

our distribution centers

• Shipping and handling expenses of E-Commerce sales

• Terms cash discount

• Compensation and benefit costs including:

• Stores

• Corporate headquarters, including buying and merchandising

• Distribution centers

• Occupancy and operating costs of our retail, distribution and

corporate facilities

• Net revenues from the Kohl’s credit card agreement with JPMorgan Chase

• Freight expenses associated with moving merchandise from our distribution

centers to our retail stores, and among distribution and retail facilities

• Advertising expenses, offset by vendor payments for reimbursement of

specific, incremental and identifiable costs

• Costs incurred prior to new store openings, such as advertising,

hiring and training costs for new employees, processing and

transporting initial merchandise, and rent expense

• Other administrative costs

The classification of these expenses varies across the retail industry.

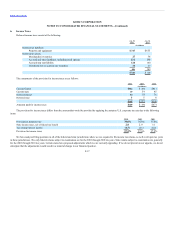

We receive consideration for a variety of vendor-sponsored programs, such as markdown allowances, volume rebates and promotion and advertising

support. The vendor consideration is recorded either as a reduction of inventory costs or Selling, General and Administrative (“SG&A”) expenses based on the

application of Accounting Standards Codification (“ASC”) No. 605, Subtopic 50, “Customer Payments and Incentives.” Promotional and advertising

allowances are intended to offset our advertising costs to promote vendors’ merchandise. Markdown allowances and volume rebates are recorded as a reduction

of inventory costs.

F-11