McDonalds 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 McDonalds annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 McDonald’s Corporation 2014 Annual Report

Notes to Consolidated Financial Statements

Summary of Significant Accounting Policies

NATURE OF BUSINESS

The Company franchises and operates McDonald’s restaurants in

the global restaurant industry. All restaurants are operated either

by the Company or by franchisees, including conventional

franchisees under franchise arrangements, and foreign affiliates

and developmental licensees under license agreements.

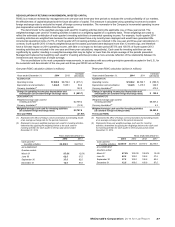

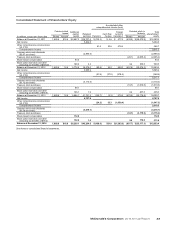

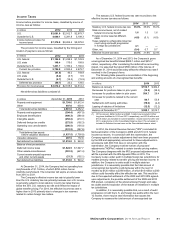

The following table presents restaurant information by

ownership type:

Restaurants at December 31, 2014 2013 2012

Conventional franchised 20,774 20,355 19,869

Developmental licensed 5,228 4,747 4,350

Foreign affiliated 3,542 3,589 3,663

Franchised 29,544 28,691 27,882

Company-operated 6,714 6,738 6,598

Systemwide restaurants 36,258 35,429 34,480

The results of operations of restaurant businesses purchased

and sold in transactions with franchisees were not material either

individually or in the aggregate to the consolidated financial

statements for periods prior to purchase and sale.

CONSOLIDATION

The consolidated financial statements include the accounts of the

Company and its subsidiaries. Investments in affiliates owned 50%

or less (primarily McDonald’s Japan) are accounted for by the

equity method.

On an ongoing basis, the Company evaluates its business

relationships such as those with franchisees, joint venture

partners, developmental licensees, suppliers, and advertising

cooperatives to identify potential variable interest entities.

Generally, these businesses qualify for a scope exception under

the variable interest entity consolidation guidance. The Company

has concluded that consolidation of any such entity is not

appropriate for the periods presented.

ESTIMATES IN FINANCIAL STATEMENTS

The preparation of financial statements in conformity with

accounting principles generally accepted in the U.S. requires

management to make estimates and assumptions that affect the

amounts reported in the financial statements and accompanying

notes. Actual results could differ from those estimates.

REVENUE RECOGNITION

The Company’s revenues consist of sales by Company-operated

restaurants and fees from franchised restaurants operated by

conventional franchisees, developmental licensees and foreign

affiliates.

Sales by Company-operated restaurants are recognized on a

cash basis. The Company presents sales net of sales tax and

other sales-related taxes. Revenues from conventional franchised

restaurants include rent and royalties based on a percent of sales

with minimum rent payments, and initial fees. Revenues from

restaurants licensed to foreign affiliates and developmental

licensees include a royalty based on a percent of sales, and may

include initial fees. Continuing rent and royalties are recognized in

the period earned. Initial fees are recognized upon opening of a

restaurant or granting of a new franchise term, which is when the

Company has performed substantially all initial services required

by the franchise arrangement.

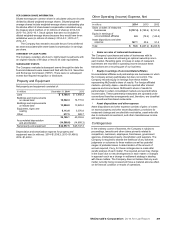

In May 2014, the Financial Accounting Standards Board

issued guidance codified in Accounting Standards Codification

("ASC") 606, "Revenue Recognition - Revenue from Contracts

with Customers," which amends the guidance in ASC 605,

"Revenue Recognition," and becomes effective beginning

January 1, 2017. The Company is currently evaluating the impact

of the provisions of ASC 606.

FOREIGN CURRENCY TRANSLATION

Generally, the functional currency of operations outside the U.S. is

the respective local currency.

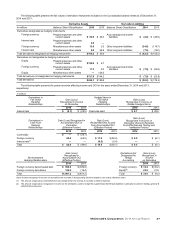

ADVERTISING COSTS

Advertising costs included in operating expenses of Company-

operated restaurants primarily consist of contributions to

advertising cooperatives and were (in millions): 2014–$808.2;

2013–$808.4; 2012–$787.5. Production costs for radio and

television advertising are expensed when the commercials are

initially aired. These production costs, primarily in the U.S., as well

as other marketing-related expenses included in Selling, general &

administrative expenses were (in millions): 2014–$98.7; 2013–

$75.4; 2012–$113.5. Costs related to the Olympics sponsorship

are included in these expenses for 2014 and 2012. In addition,

significant advertising costs are incurred by franchisees through

contributions to advertising cooperatives in individual markets.

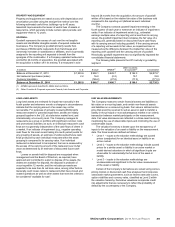

SHARE-BASED COMPENSATION

Share-based compensation includes the portion vesting of all

share-based awards granted based on the grant date fair value.

Share-based compensation expense and the effect on diluted

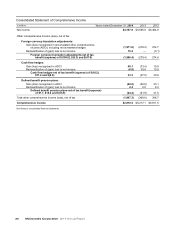

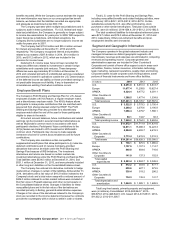

earnings per common share were as follows:

In millions, except per share data 2014 2013 2012

Share-based compensation expense $112.8 $ 89.1 $ 93.4

After tax $ 72.8 $ 60.6 $ 63.2

Earnings per common share-diluted $ 0.08 $ 0.06 $ 0.06

Compensation expense related to share-based awards is

generally amortized on a straight-line basis over the vesting period

in Selling, general & administrative expenses. As of December 31,

2014, there was $97.3 million of total unrecognized compensation

cost related to nonvested share-based compensation that is

expected to be recognized over a weighted-average period of 1.9

years.

The fair value of each stock option granted is estimated on

the date of grant using a closed-form pricing model. The following

table presents the weighted-average assumptions used in the

option pricing model for the 2014, 2013 and 2012 stock option

grants. The expected life of the options represents the period of

time the options are expected to be outstanding and is based on

historical trends. Expected stock price volatility is generally based

on the historical volatility of the Company’s stock for a period

approximating the expected life. The expected dividend yield is

based on the Company’s most recent annual dividend rate. The

risk-free interest rate is based on the U.S. Treasury yield curve in

effect at the time of grant with a term equal to the expected life.

Weighted-average assumptions

2014 2013 2012

Expected dividend yield 3.3% 3.5% 2.8%

Expected stock price volatility 20.0% 20.6% 20.8%

Risk-free interest rate 2.0% 1.2% 1.1%

Expected life of options

(in years)

6.1 6.1 6.1

Fair value per option granted $12.23 $11.09 $13.65