Sprint - Nextel 2006 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2006 Sprint - Nextel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

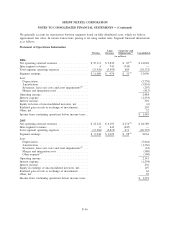

SPRINT NEXTEL CORPORATION

SCHEDULE II

VALUATION AND QUALIFYING ACCOUNTS

Years Ended December 31, 2006, 2005 and 2004

Balance

Beginning

of Year

Charged

to Income

(Loss)

Charged

to Other

Accounts

Other

Deductions

Balance

End

of Year

Additions

(in millions)

2006

Allowance for doubtful accounts .............. $ 319 $656 $ 72

(1)

$(626)

(2)

$ 421

Valuation allowance-deferred income tax assets . . . $1,070 $ 10 $ 31

(3)

$(158)

(4)

$ 953

2005

Allowance for doubtful accounts .............. $ 268 $388 $181

(1)

$(518)

(2)

$ 319

Valuation allowance-deferred income tax assets . . . $ 669 $ 15 $386

(3)

$ — $1,070

2004

Allowance for doubtful accounts .............. $ 248 $318 $131

(1)

$(429)

(2)

$ 268

Valuation allowance-deferred income tax assets . . . $ 620 $ 49 $ — $ — $ 669

The schedule above only reflects continuing operations.

(1) Amounts charged to other accounts consist of receivable reserves for billing and collection services we

provide for certain PCS Affiliates. Uncollectible accounts are recovered from affiliates. In 2005 and 2006,

the amounts include the allowance recorded in the merger of Nextel and the PCS Affiliate and Nextel Part-

ners acquisitions.

(2) Accounts written off, net of recoveries.

(3) Amount represents increases in the valuation allowance for deferred tax assets related primarily to the

purchase price allocations in the Sprint-Nextel merger and the PCS Affiliate and Nextel Partners

acquisitions.

(4) Amount represents valuation allowances no longer required due to the utilization or expiration of income

tax carryforwards.

F-63