Windstream 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

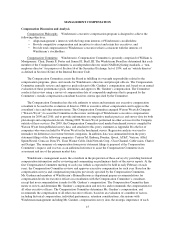

Matters.” The Governance Committee does not have a specific policy regarding the consideration of stockholder

recommendations for director candidates because the Committee intends to evaluate stockholder

recommendations in the same manner as it evaluates director candidates recommended by other sources.

Management of Windstream has the primary responsibility for managing the risks facing Windstream,

subject to the oversight of the Board of Directors. Each Committee of the Board assists the Board of Directors to

discharge its risk oversight role by performing the subject matter responsibilities outlined above in the

description of each Committee. The Board of Directors retains full oversight responsibility for all subject matters

not assigned to Committees including risks presented by business strategy, competition, regulation, general

industry trends including the disruptive impact of technological change, capital structure and allocation, and

mergers and acquisitions. The Board of Directors supplements its ability to discharge its risk oversight role by

receiving a report on the results of an annual risk assessment of Windstream that is prepared by the Internal

Audit Department. This survey is used primarily to assist the Internal Audit Department to prepare the scope of

its annual audit plan, subject to the review and approval of the Audit Committee. Internal Audit prepares the risk

assessment by conducting risk assessment interviews and surveys with management across the company to

identify individual process and company-wide risks. Internal Audit also conducts separate interviews with

members of the Board to supplement the input provided by management. Internal Audit presents an annual report

to the Audit Committee and the full Board on the top risks to Windstream identified by the assessment process.

Windstream’s Corporate Governance Board Guidelines, its code of ethics policy entitled “Working With

Integrity”, and the charters for the Audit, Compensation and Governance Committees are available on the

Investor Relations page of the Windstream Corporation website at www.windstream.com/investors. Copies of

each of these documents are also available to stockholders who submit a request to Windstream Corporation,

ATTN: Investor Relations, 4001 Rodney Parham Road, Little Rock, AR 72212. Stockholders and other interested

parties may contact the Chairman of the Board or the non-management directors of the Windstream Board of

Directors by writing to Windstream Corporation, ATTN: Chairman of the Board or Non-Management Directors,

c/o Corporate Secretary, 4001 Rodney Parham Road, Little Rock, AR 72212.

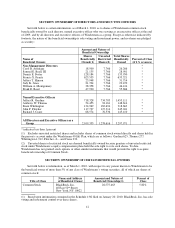

STOCK OWNERSHIP GUIDELINES

The Windstream Board of Directors has adopted minimum stock ownership guidelines for Windstream’s

directors and executive officers. Directors who are not executive officers are expected to maintain beneficial

ownership of shares of Windstream Common Stock valued at least five times the annual cash retainer paid to

non-management directors. Executive officers are expected to maintain beneficial ownership of shares of

common stock at the following levels: ten times base salary for the Chief Executive Officer; five times base

salary for each of the Chief Financial Officer, Chief Operating Officer and General Counsel; and three times base

salary for all other executive officers. Directors have a transition period of five years from their initial election

(or, for incumbent directors as of November 2006, until the date of the 2011 Annual Meeting of Stockholders),

and executive officers have a transition period of three years from their initial election to meet the applicable

ownership guidelines and, thereafter, one year to meet any increased ownership requirements resulting from

changes in stock price, annual base fee, annual base salary, or applicable ownership levels occurring since the

initial deadline. During the transition period and until the director or officer satisfies the specified ownership

levels, the guidelines impose a retention ratio that provides that each officer and director is expected to retain at

least 50% of the shares received, net of tax payment obligations, upon the vesting of restricted stock or the

exercise of stock options. Directors and officers are also required to hold for at least six months all shares

received, net of tax payment obligations, upon vesting of restricted stock or the exercise of stock options. For the

purposes of the guidelines, unvested shares of restricted stock are considered to be owned.

10