eBay 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

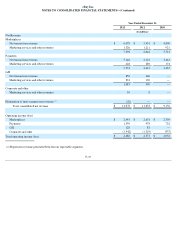

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Stock-based compensation

We issue two types of stock-based awards to employees: restricted stock units (including performance-based restricted stock units) and

stock options. We primarily issue restricted stock units. We determine compensation expense associated with restricted stock units based on the

fair value of our common stock on the date of grant. We determine compensation expense associated with stock options based on the estimated

grant date fair value method using the Black-Scholes valuation model. We generally recognize compensation expense using a straight-line

amortization method over the respective vesting period for awards that are ultimately expected to vest. Accordingly, stock-based compensation

expense for 2012 , 2011 and 2010 has been reduced for estimated forfeitures. When estimating forfeitures, we consider voluntary termination

behaviors as well as trends of actual option forfeitures. We recognize a benefit from stock-based compensation in equity to the extent that an

incremental tax benefit is realized by following the ordering provisions of the tax law. In addition, we account for the indirect effects of stock-

based compensation on the research tax credit and the foreign tax credit through our consolidated statement of income.

Provision for transaction losses

We are exposed to losses due to payment card and other payment misuse, as well as non-performance of and credit losses from sellers.

Provisions for these items represent our estimate of actual losses based on our historical experience and actuarial techniques, as well as economic

conditions. Provision for transaction losses includes PayPal's transaction loss expense as well as losses resulting from our customer protection

programs on and off our platforms.

Income taxes

We account for income taxes using an asset and liability approach, which requires the recognition of taxes payable or refundable for the

current year and deferred tax liabilities and assets for the future tax consequences of events that have been recognized in our financial statements

or tax returns. The measurement of current and deferred tax assets and liabilities is based on provisions of enacted tax laws; the effects of future

changes in tax laws or rates are not anticipated. If necessary, the measurement of deferred tax assets is reduced by the amount of any tax benefits

that are not expected to be realized based on available evidence.

We report a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken in a tax return. We

recognize interest and penalties, if any, related to unrecognized tax benefits in income tax expense.

Cash and cash equivalents

Cash and cash equivalents are short-term, highly liquid investments with original maturities of three months or less when purchased and

are mainly comprised of bank deposits, money market funds and commercial paper.

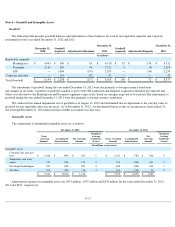

Allowance for doubtful accounts and authorized credits

We record our allowance for doubtful accounts based upon our assessment of various factors. We consider historical experience, the age of

the accounts receivable balances, credit quality of our customers, current economic conditions and other factors that may affect our customers'

ability to pay. The allowance for doubtful accounts and authorized credits was $89 million and $87 million at December 31, 2012 and 2011 ,

respectively.

Loans and interest receivable, net

Loans and interest receivable represent purchased consumer receivables arising from loans made by a partner chartered financial institution

to individual consumers in the U.S. to purchase goods and services through our Bill Me Later merchant network. The terms of the consumer

relationship require us to submit monthly bills to the consumer detailing loan repayment requirements. The terms also allow us to charge the

consumer interest and fees in certain circumstances. Due to the relatively small dollar amount of individual loans and interest receivable, we do

not require collateral on these balances.

F-10