eBay 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

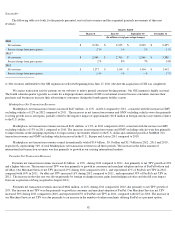

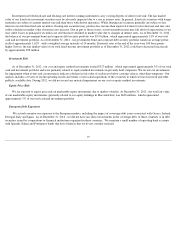

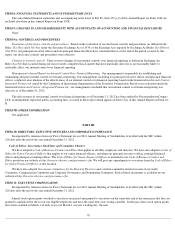

We have certain fixed contractual obligations and commitments that include future estimated payments for general operating purposes.

Changes in our business needs, contractual cancellation provisions, fluctuating interest rates, and other factors may result in actual payments

differing from the estimates. We cannot provide certainty regarding the timing and amounts of these payments. The following table summarizes

our fixed contractual obligations and commitments:

The significant assumptions used in our determination of amounts presented in the above table are as follows:

As we are unable to reasonably predict the timing of settlement of liabilities related to unrecognized tax benefits, net, the table does not

include $457 million of such non-current liabilities included in deferred and other tax liabilities recorded on our consolidated balance sheet as of

December 31, 2012 .

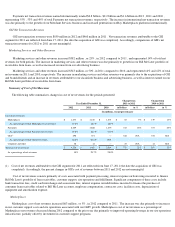

Liquidity and Capital Resource Requirements

At December 31, 2012 , we had assets classified as cash and cash equivalents, as well as short and long-term non-

equity investments, in an

aggregate amount of $11.5 billion , compared to $7.5 billion at December 31, 2011 . At December 31, 2012 , this amount included assets held in

certain of our foreign operations totaling approximately $7.7 billion . If these assets were distributed to the U.S., we may be subject to additional

U.S. taxes in certain circumstances. We actively monitor all counterparties that hold these assets, primarily focusing on the safety of principal

and secondarily improving yield on these assets. We diversify our cash and cash equivalents and investments among various counterparties in

order to reduce our exposure should any one of these counterparties fail or encounter difficulties. To date, we have not experienced any material

loss or lack of access to our invested cash, cash equivalents or short-term investments; however, we can provide no assurances that access to our

invested cash, cash equivalents or short-term investments will not be impacted by adverse conditions in the financial markets. At any point in

time we have funds in our operating accounts and customer accounts that are deposited with third party financial institutions.

To the extent that our Bill Me Later products become more widely available through improved and more comprehensive product

integrations with eBay, PayPal and other channels, and as we further promote Bill Me Later products, we expect customer adoption and usage of

Bill Me Later products to expand. Any resulting growth in the portfolio of Bill Me Later loan receivables would increase our liquidity needs and

any failure to meet those liquidity needs could adversely affect the Bill Me Later business. We currently fund the expansion of the Bill Me Later

portfolio of loan receivables with borrowings and domestic and international cash resources.

71

Payments Due During the Year Ending December 31,

Debt/Capital

Leases

Leases

Purchase

Obligations

Total

(In millions)

2013

$

511

$

99

$

345

$

955

2014

114

80

130

324

2015

948

67

108

1,123

2016

86

45

113

244

2017

1,086

36

114

1,236

Thereafter

3,148

43

4

3,195

$

5,893

$

370

$

814

$

7,077

• Debt and capital lease amounts include the principal and interest amounts of the respective debt instruments and the present value of

capital lease payments. For additional details related to our debt, please see “Note 11 – Debt” to the consolidated financial statements

included in this report. This table does not reflect any amounts payable under our $3 billion revolving credit facility or $2 billion

commercial paper program, as no borrowings were outstanding as of December 31, 2012.

• Lease amounts include minimum rental payments under our non-cancelable operating leases for office facilities, fulfillment centers,

as well as computer and office equipment that we utilize under lease arrangements. The amounts presented are consistent with

contractual terms and are not expected to differ significantly from actual results under our existing leases, unless a substantial change

in our headcount needs requires us to expand our occupied space or exit an office facility early.

• Purchase obligation amounts include minimum purchase commitments for advertising, capital expenditures (computer equipment,

software applications, engineering development services, construction contracts) and other goods and services entered into in the

ordinary course of business.