Apple 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 Apple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

condition.

The Company's stock price may be volatile.

The Company's stock has experienced substantial price volatility as a result of variations between its actual and anticipated financial results and

as a result of announcements by the Company and its competitors. In addition, the stock market has experienced extreme price and volume

fluctuations that have affected the market price of many technology companies in ways that have been unrelated to the operating performance

of these companies. These factors, as well as general economic and political conditions, may materially adversely affect the market price of the

Company's common stock in the future.

32

Item 7A. Disclosures About Market Risk

Interest Rate and Foreign Currency Risk Management

To ensure the adequacy and effectiveness of the Company's foreign exchange and interest rate hedge positions, as well as to monitor the risks

and opportunities of the non-hedge portfolios, the Company continually monitors its foreign exchange forward and option positions, and its

interest rate swap and option positions both on a stand-alone basis and in conjunction with its underlying foreign currency and interest rate

related exposures, respectively, from both an accounting and an economic perspective. However, given the effective horizons of the Company's

risk management activities and the anticipatory nature of the exposures intended to hedge, there can be no assurance the aforementioned

programs will offset more than a portion of the adverse financial impact resulting from unfavorable movements in either foreign exchange or

interest rates. In addition, the timing of the accounting for recognition of gains and losses related to mark-to-market instruments for any given

period may not coincide with the timing of gains and losses related to the underlying economic exposures and, therefore, may adversely affect

the Company's operating results and financial position. The Company adopted Statement of Financial Accounting Standard No. 133,

"Accounting for Derivative Instruments and Hedging Activities," as of October 1, 2000. SFAS No. 133 establishes accounting and reporting

standards for derivative instruments, hedging activities, and exposure definition. Management does not believe that ongoing application of

SFAS No. 133 will significantly alter the Company's hedging strategies. However, its application may increase the volatility of other income

and expense and other comprehensive income.

Interest Rate Risk

While the Company is exposed to interest rate fluctuations in many of the world's leading industrialized countries, the Company's interest

income and expense is most sensitive to fluctuations in the general level of U.S. interest rates. In this regard, changes in U.S. interest rates

affect the interest earned on the Company's cash, cash equivalents, and short-

term investments as well as costs associated with foreign currency

hedges.

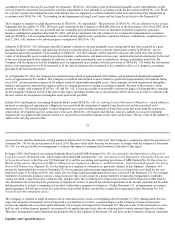

The Company's exposure to market risk for changes in interest rates relates primarily to the Company's investment portfolio and long-

term debt

obligations and related derivative financial instruments. The Company places its short-term investments in highly liquid securities issued by

high credit quality issuers and, by policy, limits the amount of credit exposure to any one issuer. The Company's general policy is to limit the

risk of principal loss and ensure the safety of invested funds by limiting market and credit risk. All highly liquid investments with maturities of

three months or less are classified as cash equivalents; highly liquid investments with maturities greater than three months are classified as

short-term investments. As of September 29, 2001, approximately $313 million of the Company's investment portfolio classified as short-term

investments was in U.S. agency securities with underlying maturities ranging from 1 to 4 years. The remainder all had underlying maturities

between 3 and 12 months. As of September 30, 2000, substantially all of the Company's investment portfolio classified as short-term

investments had maturities of between 3 and 12 months.

During 1994, the Company issued $300 million aggregate principal amount of 6.5% unsecured notes in a public offering registered with the

SEC. The notes were sold at 99.925% of par, for an effective yield to maturity of 6.51%. The notes pay interest semiannually and mature on

February 15, 2004.

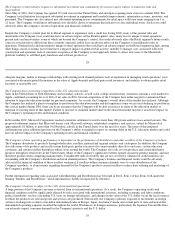

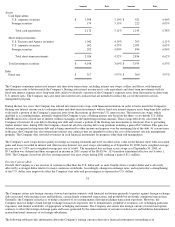

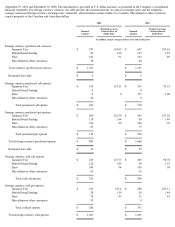

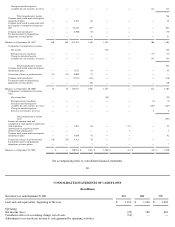

The following table presents the principal (or notional) amounts and related weighted-average interest rates for the Company's short-term

investment portfolio and its long-term debt obligations. The long-term debt is comprised of $300 million of unsecured notes described above,

which mature in February 2004. The Company's U.S. corporate securities include commercial paper, loan participations, certificates of deposit,

time deposits and corporate debt securities. Foreign securities include foreign commercial paper, loan participation, certificates of deposit and

time deposits with foreign institutions, most of which are denominated in U.S. dollars. Net unrealized gains on the Company's investment

portfolio were $11 million as of September 29, 2001 and were negligible as of September 30, 2000.

33

September 29, 2001

September 30, 2000

Carrying Weighted-Average

Interest Carrying Weighted-Average

Interest