Charter 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Charter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CHARTER COMMUNICATIONS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012, 2011 AND 2010

(dollars in millions, except share or per share data or where indicated)

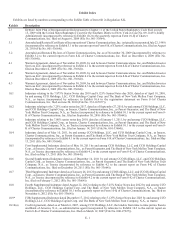

F- 8

consist of compensation and other costs associated with these support functions. Indirect costs primarily include employee benefits

and payroll taxes, direct variable costs associated with capitalizable activities, consisting primarily of installation and construction,

vehicle costs, the cost of dispatch personnel and indirect costs directly attributable to capitalizable activities. The costs of

disconnecting service at a customer’s dwelling or reconnecting service to a previously installed dwelling are charged to operating

expense in the period incurred. Costs for repairs and maintenance are charged to operating expense as incurred, while plant and

equipment replacement and betterments, including replacement of cable drops from the pole to the dwelling, are capitalized.

Depreciation is recorded using the straight-line composite method over management’s estimate of the useful lives of the related

assets as follows:

Cable distribution systems 7-20 years

Customer equipment and installations 4-8 years

Vehicles and equipment 1-6 years

Buildings and leasehold improvements 15-40 years

Furniture, fixtures and equipment 6-10 years

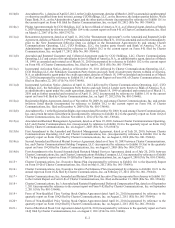

Asset Retirement Obligations

Certain of the Company’s franchise agreements and leases contain provisions requiring the Company to restore facilities or remove

equipment in the event that the franchise or lease agreement is not renewed. The Company expects to continually renew its

franchise agreements and has concluded that all of the related franchise rights are indefinite lived intangible assets. Accordingly,

the possibility is remote that the Company would be required to incur significant restoration or removal costs related to these

franchise agreements in the foreseeable future. A liability is required to be recognized for an asset retirement obligation in the

period in which it is incurred if a reasonable estimate of fair value can be made. The Company has not recorded an estimate for

potential franchise related obligations, but would record an estimated liability in the unlikely event a franchise agreement containing

such a provision were no longer expected to be renewed. The Company also expects to renew many of its lease agreements related

to the continued operation of its cable business in the franchise areas. For the Company’s lease agreements, the estimated liabilities

related to the removal provisions, where applicable, have been recorded and are not significant to the financial statements.

Franchises

Franchise rights represent the value attributed to agreements or authorizations with local and state authorities that allow access to

homes in cable service areas. Management estimates the fair value of franchise rights at the date of acquisition and determines if

the franchise has a finite life or an indefinite life. All franchises that qualify for indefinite life treatment are tested for impairment

annually or more frequently as warranted by events or changes in circumstances (see Note 5). The Company has concluded that

all of its existing franchises qualify for indefinite life treatment.

Customer Relationships

Customer relationships represent the value attributable to the Company’s business relationships with its current customers including

the right to deploy and market additional services to these customers. Customer relationships are amortized on an accelerated

basis over the period the relationships with current customers are expected to generate cash flows (11-15 years).

Goodwill

The Company assesses the recoverability of its goodwill as of November 30 of each year, or more frequently whenever events or

changes in circumstances indicate that the asset might be impaired.

Other Noncurrent Assets

Other noncurrent assets primarily include trademarks, right-of-entry costs and deferred financing costs. Trademarks have been

determined to have an indefinite life and are tested annually for impairment. Right-of-entry costs represent costs incurred related

to agreements entered into with landlords, real estate companies or owners to gain access to a building in order to provide cable