Windstream 2008 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2008 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

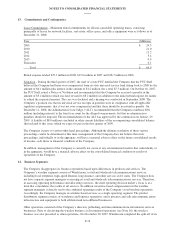

15. Supplemental Guarantor Information:

In connection with the issuance of the 2013 Notes, the 2016 Notes and the 2019 Notes (“the guaranteed notes”),

certain of the Company’s wholly-owned subsidiaries (the “Guarantors”), including all former subsidiaries of

Valor, provide guarantees of those debentures. These guarantees are full and unconditional as well as joint and

several. Certain Guarantors may be subject to restrictions on their ability to distribute earnings to the Company.

The remaining subsidiaries (the “Non-Guarantors”) of Windstream are not guarantors of the guaranteed notes. In

conjunction with the merger with Valor, Windstream assumed $400.0 million principal value of unsecured notes

(the “Valor Notes”) guaranteed by all of Valor’s operating subsidiaries. The terms of those notes were amended to

reflect the non-Valor Guarantors as guarantors of the Valor Notes. On March 1, 2007, the Company de-registered

the Valor Notes. Following the acquisition of CTC, the guaranteed notes were amended to include certain

subsidiaries of CTC as guarantors.

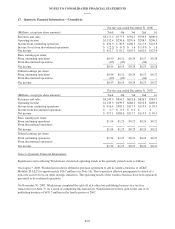

The following information presents condensed consolidated and combined statements of income for the years

ended December 31, 2008, 2007 and 2006, condensed consolidated balance sheets as of December 31, 2008 and

2007, and condensed consolidated and combined statements of cash flows for the years ended December 31, 2008,

2007 and 2006 of the parent company, the Guarantors, and the Non-Guarantors. Investments consist of

investments in net assets of subsidiaries held by the parent company and other subsidiaries, and have been

presented using the equity method of accounting.

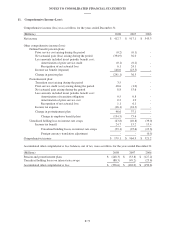

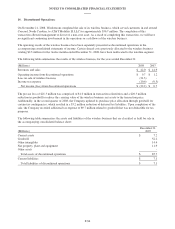

Condensed Consolidated Statement of Income

For the Year Ended December 31, 2008

(Millions) Parent Guarantors

Non-

Guarantors Eliminations Consolidated

Revenues and sales:

Service revenues $ - $ 759.3 $2,234.5 $ (5.0) $2,988.8

Product sales - 276.7 58.6 (152.6) 182.7

Total revenues and sales - 1,036.0 2,293.1 (157.6) 3,171.5

Costs and expenses:

Cost of services - 229.5 754.2 (5.0) 978.7

Cost of products sold - 260.8 57.3 (152.6) 165.5

Selling, general, administrative and other - 107.0 280.5 - 387.5

Depreciation and amortization - 169.9 322.8 - 492.7

Merger, integration and restructuring - 1.9 12.8 - 14.7

Total costs and expenses - 769.1 1,427.6 (157.6) 2,039.1

Operating income - 266.9 865.5 - 1,132.4

Earnings (losses) from consolidated subsidiaries 701.3 69.4 (0.1) (770.6) -

Other income (expense), net (4.1) 8.0 (1.8) - 2.1

Intercompany interest income (expense) (42.4) (13.7) 56.1 - -

Interest expense (407.4) (6.4) (2.6) - (416.4)

Income from continuing operations before income taxes 247.4 324.2 917.1 (770.6) 718.1

Income taxes (benefit) (165.3) 102.0 346.5 - 283.2

Income from continuing operations 412.7 222.2 570.6 (770.6) 434.9

Discontinued operations - - (22.2) - (22.2)

Net income $ 412.7 $ 222.2 $ 548.4 $(770.6) $ 412.7

F-79