Lowe's 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Lowe's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

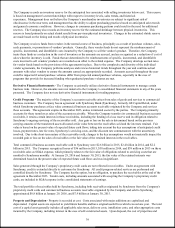

The Company records an inventory reserve for the anticipated loss associated with selling inventories below cost. This reserve

is based on management’s current knowledge with respect to inventory levels, sales trends, and historical

experience. Management does not believe the Company’s merchandise inventories are subject to significant risk of

obsolescence in the near term, and management has the ability to adjust purchasing practices based on anticipated sales trends

and general economic conditions. However, changes in consumer purchasing patterns could result in the need for additional

reserves. The Company also records an inventory reserve for the estimated shrinkage between physical inventories. This

reserve is based primarily on actual shrink results from previous physical inventories. Changes in the estimated shrink reserve

are made based on the timing and results of physical inventories.

The Company receives funds from vendors in the normal course of business, principally as a result of purchase volumes, sales,

early payments, or promotions of vendors’ products. Generally, these vendor funds do not represent the reimbursement of

specific, incremental, and identifiable costs incurred by the Company to sell the vendor’s product. Therefore, the Company

treats these funds as a reduction in the cost of inventory as the amounts are accrued, and are recognized as a reduction of cost of

sales when the inventory is sold. Funds that are determined to be reimbursements of specific, incremental, and identifiable

costs incurred to sell vendors’ products are recorded as an offset to the related expense. The Company develops accrual rates

for vendor funds based on the provisions of the agreements in place. Due to the complexity and diversity of the individual

vendor agreements, the Company performs analyses and reviews historical trends throughout the year and confirms actual

amounts with select vendors to ensure the amounts earned are appropriately recorded. Amounts accrued throughout the year

could be impacted if actual purchase volumes differ from projected annual purchase volumes, especially in the case of

programs that provide for increased funding when graduated purchase volumes are met.

Derivative Financial Instruments - The Company occasionally utilizes derivative financial instruments to manage certain

business risks. However, the amounts were not material to the Company’s consolidated financial statements in any of the years

presented. The Company does not use derivative financial instruments for trading purposes.

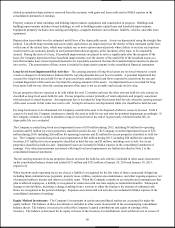

Credit Programs - The majority of the Company’s accounts receivable arises from sales of goods and services to commercial

business customers. The Company has an agreement with Synchrony Bank (Synchrony), formerly GE Capital Retail, under

which Synchrony purchases at face value commercial business accounts receivable originated by the Company and services

these accounts. This agreement expires in December 2023, unless terminated sooner by the parties. The Company primarily

accounts for these transfers as sales of the accounts receivable. When the Company transfers its commercial business accounts

receivable, it retains certain interests in those receivables, including the funding of a loss reserve and its obligation related to

Synchrony’s ongoing servicing of the receivables sold. Any gain or loss on the sale is determined based on the previous

carrying amounts of the transferred assets allocated at fair value between the receivables sold and the interests retained. Fair

value is based on the present value of expected future cash flows, taking into account the key assumptions of anticipated credit

losses, payment rates, late fee rates, Synchrony’s servicing costs, and the discount rate commensurate with the uncertainty

involved. Due to the short-term nature of the receivables sold, changes to the key assumptions would not materially impact the

recorded gain or loss on the sales of receivables or the fair value of the retained interests in the receivables.

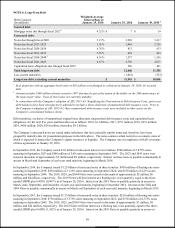

Total commercial business accounts receivable sold to Synchrony were $2.6 billion in 2015, $2.4 billion in 2014, and $2.2

billion in 2013. The Company recognized losses of $36 million in 2015, $38 million in 2014, and $38 million in 2013 on these

receivable sales as SG&A expense, which primarily relates to the fair value of obligations related to servicing costs that are

remitted to Synchrony monthly. At January 29, 2016 and January 30, 2015, the fair value of the retained interests was

determined based on the present value of expected future cash flows and was insignificant.

Sales generated through the Company’s proprietary credit cards are not reflected in receivables. Under an agreement with

Synchrony, credit is extended directly to customers by Synchrony. All credit program-related services are performed and

controlled directly by Synchrony. The Company has the option, but no obligation, to purchase the receivables at the end of the

agreement in December 2023. Tender costs, including amounts associated with accepting the Company’s proprietary credit

cards, are included in SG&A expense in the consolidated statements of earnings.

The total portfolio of receivables held by Synchrony, including both receivables originated by Synchrony from the Company’s

proprietary credit cards and commercial business accounts receivable originated by the Company and sold to Synchrony,

approximated $8.8 billion at January 29, 2016, and $7.9 billion at January 30, 2015.

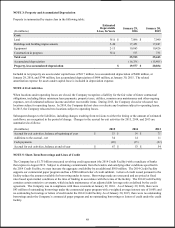

Property and Depreciation - Property is recorded at cost. Costs associated with major additions are capitalized and

depreciated. Capital assets are expected to yield future benefits and have original useful lives which exceed one year. The total

cost of a capital asset generally includes all applicable sales taxes, delivery costs, installation costs, and other appropriate costs

incurred by the Company, including interest in the case of self-constructed assets. Upon disposal, the cost of properties and