Nike 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

were issued in an initial aggregate principal amount of $500 million at a 2.25%

fixed, annual interest rate and will mature on May 1, 2023. The 2043 senior

notes were issued in an initial aggregate principal amount of $500 million at a

3.625% fixed, annual interest rate and will mature on May 1, 2043. Interest on

the senior notes is payable semi-annually on May 1 and November 1 of each

year. The issuance resulted in gross proceeds before expenses of $998

million.

On November 1, 2011, we entered into a committed credit facility agreement

with a syndicate of banks which provides for up to $1 billion of borrowings

with the option to increase borrowings to $1.5 billion with lender approval. The

facility matures November 1, 2017. As of and for the periods ended May 31,

2015 and 2014, we had no amounts outstanding under our committed credit

facility.

We currently have long-term debt ratings of AA- and A1 from Standard and

Poor’s Corporation and Moody’s Investor Services, respectively. If our long-

term debt ratings were to decline, the facility fee and interest rate under our

committed credit facility would increase. Conversely, if our long-term debt

rating were to improve, the facility fee and interest rate would decrease.

Changes in our long-term debt rating would not trigger acceleration of

maturity of any then-outstanding borrowings or any future borrowings under

the committed credit facility. Under this committed revolving credit facility, we

have agreed to various covenants. These covenants include limits on our

disposal of fixed assets, the amount of debt secured by liens we may incur, as

well as a minimum capitalization ratio. In the event we were to have any

borrowings outstanding under this facility and failed to meet any covenant,

and were unable to obtain a waiver from a majority of the banks in the

syndicate, any borrowings would become immediately due and payable. As

of May 31, 2015, we were in full compliance with each of these covenants

and believe it is unlikely we will fail to meet any of these covenants in the

foreseeable future.

Liquidity is also provided by our $1 billion commercial paper program. During

the year ended May 31, 2015, we did not issue commercial paper, and as of

May 31, 2015, there were no outstanding borrowings under this program. We

may issue commercial paper or other debt securities during fiscal 2016

depending on general corporate needs. We currently have short-term debt

ratings of A1+ and P1 from Standard and Poor’s Corporation and Moody’s

Investor Services, respectively.

As of May 31, 2015, we had cash, cash equivalents and short-term

investments totaling $5.9 billion, of which $4.2 billion was held by our foreign

subsidiaries. Included in Cash and equivalents as of May 31, 2015 was $968

million of cash collateral received from counterparties as a result of hedging

activity. Cash equivalents and Short-term investments consist primarily of

deposits held at major banks, money market funds, commercial paper,

corporate notes, U.S. Treasury obligations, U.S. government sponsored

enterprise obligations and other investment grade fixed income

securities. Our fixed income investments are exposed to both credit and

interest rate risk. All of our investments are investment grade to minimize our

credit risk. While individual securities have varying durations, as of May 31,

2015 the weighted average remaining duration of our short-term investments

and cash equivalents portfolio was 79 days.

To date we have not experienced difficulty accessing the credit markets or

incurred higher interest costs. Future volatility in the capital markets, however,

may increase costs associated with issuing commercial paper or other debt

instruments or affect our ability to access those markets. We believe that

existing cash, cash equivalents, short-term investments and cash generated

by operations, together with access to external sources of funds as described

above, will be sufficient to meet our domestic and foreign capital needs in the

foreseeable future.

We utilize a variety of tax planning and financing strategies to manage our

worldwide cash and deploy funds to locations where they are needed. We

routinely repatriate a portion of our foreign earnings for which U.S. taxes have

previously been provided. We also indefinitely reinvest a significant portion of

our foreign earnings, and our current plans do not demonstrate a need to

repatriate these earnings. Should we require additional capital in the United

States, we may elect to repatriate indefinitely reinvested foreign funds or raise

capital in the United States through debt. If we were to repatriate indefinitely

reinvested foreign funds, we would be required to accrue and pay additional

U.S. taxes less applicable foreign tax credits. If we elect to raise capital in the

United States through debt, we would incur additional interest expense.

Off-Balance Sheet Arrangements

In connection with various contracts and agreements, we routinely provide

indemnification relating to the enforceability of intellectual property rights,

coverage for legal issues that arise and other items where we are acting as the

guarantor. Currently, we have several such agreements in place. However,

based on our historical experience and the estimated probability of future loss,

we have determined that the fair value of such indemnification is not material

to our financial position or results of operations.

Contractual Obligations

Our significant long-term contractual obligations as of May 31, 2015 and significant endorsement contracts, including related marketing commitments, entered

into through the date of this report are as follows:

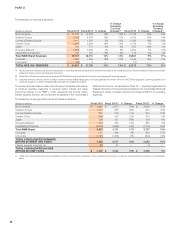

Description of Commitment Cash Payments Due During the Year Ending May 31,

(In millions) 2016 2017 2018 2019 2020 Thereafter Total

Operating Leases $ 447 $ 423 $ 371 $ 311 $ 268 $ 1,154 $ 2,974

Capital Leases 2 2 1 — — — 5

Long-term Debt(1) 142 77 55 36 36 1,451 1,797

Endorsement Contracts(2) 1,009 919 882 706 533 2,143 6,192

Product Purchase Obligations(3) 3,735 —————3,735

Other(4) 343 152 75 72 36 92 770

TOTAL $ 5,678 $ 1,573 $ 1,384 $ 1,125 $ 873 $ 4,840 $ 15,473

(1) The cash payments due for long-term debt include estimated interest payments. Estimates of interest payments are based on outstanding principal amounts, applicable fixed interest rates

or currently effective interest rates as of May 31, 2015 (if variable), timing of scheduled payments and the term of the debt obligations.

(2) The amounts listed for endorsement contracts represent approximate amounts of base compensation and minimum guaranteed royalty fees we are obligated to pay athlete, sport team

and league endorsers of our products. Actual payments under some contracts may be higher than the amounts listed as these contracts provide for bonuses to be paid to the endorsers

based upon athletic achievements and/or royalties on product sales in future periods. Actual payments under some contracts may also be lower as these contracts include provisions for

reduced payments if athletic performance declines in future periods.

In addition to the cash payments, we are obligated to furnish our endorsers with NIKE product for their use. It is not possible to determine how much we will spend on this product on an

annual basis as the contracts generally do not stipulate a specific amount of cash to be spent on the product. The amount of product provided to the endorsers will depend on many

factors, including general playing conditions, the number of sporting events in which they participate and our own decisions regarding product and marketing initiatives. In addition, the

costs to design, develop, source and purchase the products furnished to the endorsers are incurred over a period of time and are not necessarily tracked separately from similar costs

incurred for products sold to customers.

98