ICICI Bank 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 Annual Report 2014-2015

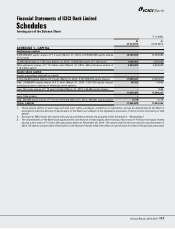

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

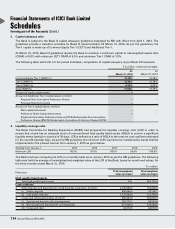

SCHEDULE 17

SIGNIFICANT ACCOUNTING POLICIES

Overview

ICICI Bank Limited (ICICI Bank or the Bank), incorporated in Vadodara, India is a publicly held banking company engaged in

providing a wide range of banking and financial services including commercial banking and treasury operations. ICICI Bank

is a banking company governed by the Banking Regulation Act, 1949. The Bank also has overseas branches in Bahrain,

Dubai, Hong Kong, Qatar, Sri Lanka, China, Singapore, United States of America and Offshore Banking Unit.

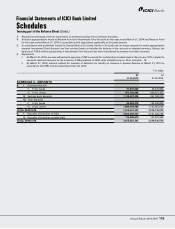

Basis of preparation

The financial statements have been prepared in accordance with requirements prescribed under the Third Schedule of

the Banking Regulation Act, 1949. The accounting and reporting policies of ICICI Bank used in the preparation of these

financial statements conform to Generally Accepted Accounting Principles in India (Indian GAAP), the guidelines issued

by Reserve Bank of India (RBI) from time to time, Companies Act, 2013 and the Accounting Standards (AS) issued by the

Institute of Chartered Accountants of India (ICAI) and notified under the Companies (Accounting Standards) Rules, 2006 to

the extent applicable and practices generally prevalent in the banking industry in India. The Bank follows the historical cost

convention and the accrual method of accounting, except in the case of interest income on non-performing assets (NPAs)

where it is recognised upon realisation.

The preparation of financial statements requires the management to make estimates and assumptions that are considered

in the reported amounts of assets and liabilities (including contingent liabilities) as of the date of the financial statements

and the reported income and expenses during the reporting period. Management believes that the estimates used in the

preparation of the financial statements are prudent and reasonable. Future results could differ from these estimates.

Significant Accounting Policies

1. Revenue recognition

a) Interest income is recognised in the profit and loss account as it accrues except in the case of non-performing

assets (NPAs) where it is recognised upon realisation, as per the income recognition and asset classification norms

of RBI.

b) Income from finance leases is calculated by applying the interest rate implicit in the lease to the net investment

outstanding on the lease over the primary lease period. Finance leases entered into prior to April 1, 2001 have

been accounted for as per the Guidance Note on Accounting for Leases issued by ICAI. The finance leases entered

post April 1, 2001 have been accounted for as per Accounting Standard 19 - Leases.

c) Income on discounted instruments is recognised over the tenure of the instrument on a constant yield basis.

d) Dividend income is accounted on accrual basis when the right to receive the dividend is established.

e) Loan processing fee is accounted for upfront when it becomes due.

f) Project appraisal/structuring fee is accounted for on the completion of the agreed service.

g) Arranger fee is accounted for as income when a significant portion of the arrangement/syndication is completed.

h) Commission received on guarantees issued is amortised on a straight-line basis over the period of the guarantee.

i) All other fees are accounted for as and when they become due.

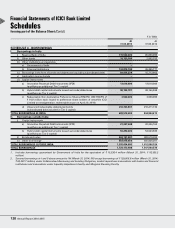

j) Net income arising from sell-down/securitisation of loan assets prior to February 1, 2006 has been recognised

upfront as interest income. With effect from February 1, 2006, net income arising from securitisation of loan assets

is amortised over the life of securities issued or to be issued by the special purpose vehicle/special purpose entity

to which the assets are sold. Net income arising from sale of loan assets through direct assignment with recourse

obligation is amortised over the life of underlying assets sold and net income from sale of loan assets through

direct assignment, without any recourse obligation, is recognised at the time of sale. Net loss arising on account

of the sell-down/securitisation and direct assignment of loan assets is recognised at the time of sale.