ICICI Bank 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 Annual Report 2014-2015

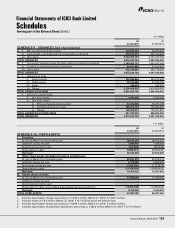

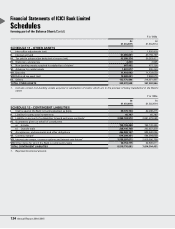

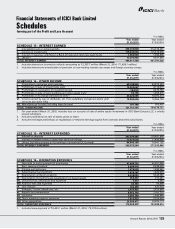

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

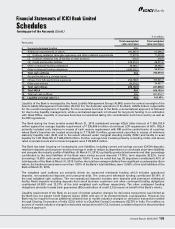

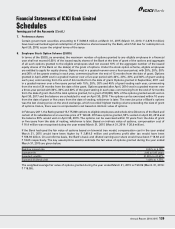

10. Income Taxes

Income tax expense is the aggregate amount of current tax and deferred tax expense incurred by the Bank. The current

tax expense and deferred tax expense is determined in accordance with the provisions of the Income Tax Act, 1961

and as per Accounting Standard 22 - Accounting for Taxes on Income respectively. Deferred tax adjustments comprise

changes in the deferred tax assets or liabilities during the year. Deferred tax assets and liabilities are recognised by

considering the impact of timing differences between taxable income and accounting income for the current year,

and carry forward losses. Deferred tax assets and liabilities are measured using tax rates and tax laws that have been

enacted or substantively enacted at the balance sheet date. The impact of changes in deferred tax assets and liabilities

is recognised in the profit and loss account. Deferred tax assets are recognised and re-assessed at each reporting date,

based upon management’s judgement as to whether their realisation is considered as reasonably/virtually certain.

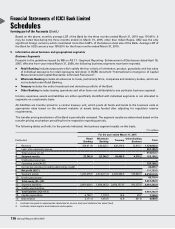

11. Impairment of Assets

The immovable fixed assets are reviewed for impairment whenever events or changes in circumstances indicate that

the carrying amount of an asset may not be recoverable. An asset is treated as impaired when its carrying amount

exceeds its recoverable amount. The impairment is recognised by debiting the profit and loss account and is measured

as the amount by which the carrying amount of the impaired assets exceeds their recoverable value.

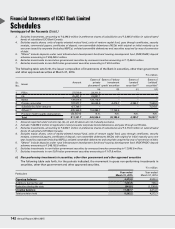

12. Provisions, contingent liabilities and contingent assets

The Bank estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of

information available up to the date on which the financial statements are prepared. A provision is recognised when

an enterprise has a present obligation as a result of a past event and it is probable that an outflow of resources will

be required to settle the obligation, in respect of which a reliable estimate can be made. Provisions are determined

based on management estimates of amounts required to settle the obligation at the balance sheet date, supplemented

by experience of similar transactions. These are reviewed at each balance sheet date and adjusted to reflect the

current management estimates. In cases where the available information indicates that the loss on the contingency is

reasonably possible but the amount of loss cannot be reasonably estimated, a disclosure to this effect is made in the

financial statements. In case of remote possibility neither provision nor disclosure is made in the financial statements.

The Bank does not account for or disclose contingent assets, if any.

The Bank estimates the probability of redemption of customer loyalty reward points using an actuarial method by

employing an independent actuary and accordingly makes provision for these reward points. Actuarial valuation is

determined based on certain assumptions regarding mortality rate, discount rate, cancellation rate and redemption

rate.

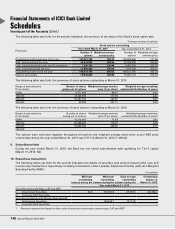

13. Earnings per share (EPS)

Basic and diluted earnings per share are computed in accordance with Accounting Standard 20 – Earnings per share.

Basic earnings per share is calculated by dividing the net profit or loss after tax for the year attributable to equity

shareholders by the weighted average number of equity shares outstanding during the year.

Diluted earnings per share reflect the potential dilution that could occur if contracts to issue equity shares were

exercised or converted during the year. Diluted earnings per equity share is computed using the weighted average

number of equity shares and dilutive potential equity shares outstanding during the year, except where the results are

anti-dilutive.

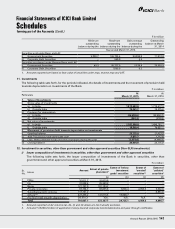

14. Lease transactions

Lease payments for assets taken on operating lease are recognised as an expense in the profit and loss account over

the lease term on straight line basis.

15. Cash and cash equivalents

Cash and cash equivalents include cash in hand, balances with RBI, balances with other banks and money at call and

short notice.