American Airlines 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

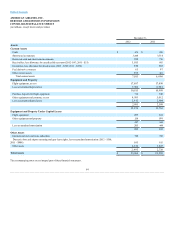

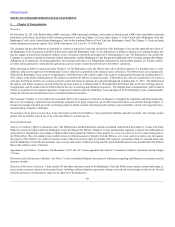

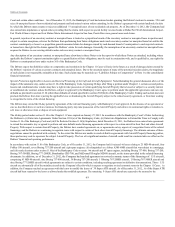

approximately $2 million. These amounts are determined by considering the impact of the hypothetical interest rates on the Company’s variable rate long-term

debt and cash and short-term investment balances at December 31, 2012 and 2011.

Market risk for fixed rate long-term debt is estimated as the potential increase in fair value resulting from a hypothetical 10 percent decrease in interest rates

and amounts to approximately $175 million and $281 million as of December 31, 2012 and 2011, respectively. The fair values of the Company’s long-term

debt were estimated using quoted market prices or discounted future cash flows based on the Company’s incremental borrowing rates for similar types of

borrowing arrangements.

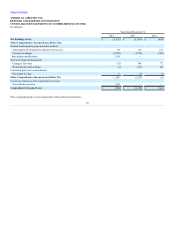

In accordance with ASC 852, the Debtors record interest expense only to the extent (1) interest will be paid during the Chapter 11 Cases or (2) it is probable

that the Bankruptcy Court will allow a claim in respect of such interest. Interest expense recorded on the Consolidated Statements of Operations totaled $662

million and $689 million for the years ended December 31, 2012 and 2011, respectively. Contractual interest expense (including interest expense that is

associated with obligations in liabilities subject to compromise) during the years ended December 31, 2012 and 2011 totaled $686 million and $691 million,

respectively.

59