Apple 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Apple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

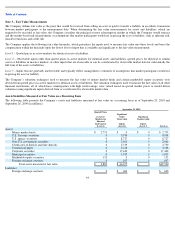

Stock Option Activity

A summary of the Company’

s stock option and RSU activity and related information for the three years ended September 25, 2010, is as follows

(in thousands, except per share amounts and contractual term in years):

Aggregate intrinsic value represents the value of the Company’

s closing stock price on the last trading day of the fiscal period in excess of the

weighted-

average exercise price multiplied by the number of options outstanding or exercisable. The aggregate intrinsic value excludes the effect

of stock options that have a zero or negative intrinsic value. Total intrinsic value of options at time of exercise was $2.0 billion, $827 million and

$2.0 billion for 2010, 2009 and 2008, respectively.

RSUs granted are deducted from the shares available for grant under the Company’

s stock option plans utilizing a factor of two times the number

of RSUs granted. Similarly, RSUs cancelled are added back to the shares available for grant under the Company’

s stock option plans utilizing a

factor of two times the number of RSUs cancelled. Outstanding RSU balances are not included in the outstanding options balances in the stock

option activity table.

74

Outstanding Options

Shares

Available

for Grant

Number

of Shares

Weighted

-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

Balance at September 29, 2007

67,827

49,751

$

43.91

Restricted stock units granted

(9,834

)

0

$

0

Options granted

(9,359

)

9,359

$

171.36

Options cancelled

1,236

(1,236

)

$

98.40

Restricted stock units cancelled

714

0

$

0

Options exercised

0

(13,728

)

$

27.88

Plan shares expired

(12

)

0

$

0

Balance at September 27, 2008

50,572

44,146

$

74.39

Restricted stock units granted

(15,572

)

0

$

0

Options granted

(234

)

234

$

106.84

Options cancelled

1,241

(1,241

)

$

122.98

Restricted stock units cancelled

1,256

0

$

0

Options exercised

0

(8,764

)

$

41.78

Plan shares expired

(2

)

0

$

0

Balance at September 26, 2009

37,261

34,375

$

81.17

Additional shares authorized

36,000

0

$

0

Restricted stock units granted

(12,356

)

0

$

0

Options granted

(34

)

34

$

202.00

Options assumed

0

98

$

11.99

Options cancelled

430

(430

)

$

136.27

Restricted stock units cancelled

1,444

0

$

0

Options exercised

0

(12,352

)

$

62.69

Plan shares expired

(8

)

0

$

0

Balance at September 25, 2010

62,737

21,725

$

90.46

2.85

$

4,385,291

Exercisable at September 25, 2010

17,791

$

77.74

2.57

$

3,817,663

Expected to vest after September 25, 2010

3,880

$

148.03

4.12

$

559,882