Coca Cola 2005 Annual Report Download - page 70

Download and view the complete annual report

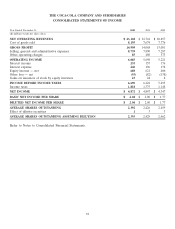

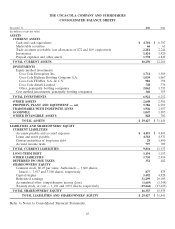

Please find page 70 of the 2005 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE COCA-COLA COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1: BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business

The Coca-Cola Company is predominantly a manufacturer, distributor and marketer of nonalcoholic

beverage concentrates and syrups. We also manufacture, distribute and market some finished beverages. In

these notes, the terms ‘‘Company,’’ ‘‘we,’’ ‘‘us’’ or ‘‘our’’ mean The Coca-Cola Company and all subsidiaries

included in the consolidated financial statements. Operating in more than 200 countries worldwide, we primarily

sell our concentrates and syrups, as well as some finished beverages, to bottling and canning operations,

distributors, fountain wholesalers and fountain retailers. We also market and distribute juice and juice drinks,

sports drinks, water products, teas, coffees and other beverage products. Additionally, we have ownership

interests in numerous bottling and canning operations. Significant markets for our products exist in all the

world’s geographic regions.

Basis of Presentation and Consolidation

Our consolidated financial statements are prepared in accordance with accounting principles generally

accepted in the United States. Our Company consolidates all entities that we control by ownership of a majority

voting interest as well as variable interest entities for which our Company is the primary beneficiary. Refer to the

heading ‘‘Variable Interest Entities,’’ below, for a discussion of variable interest entities.

We use the equity method to account for our investments for which we have the ability to exercise

significant influence over operating and financial policies. Consolidated net income includes our Company’s

share of the net income of these companies.

We use the cost method to account for our investments in companies that we do not control and for which

we do not have the ability to exercise significant influence over operating and financial policies. In accordance

with the cost method, these investments are recorded at cost or fair value, as appropriate.

We eliminate from our financial results all significant intercompany transactions, including the

intercompany transactions with variable interest entities and the intercompany portion of transactions with

equity method investees.

Certain amounts in the prior years’ consolidated financial statements have been reclassified to conform to

the current-year presentation.

Variable Interest Entities

In December 2003, the Financial Accounting Standards Board (‘‘FASB’’) issued FASB Interpretation

No. 46 (revised December 2003), ‘‘Consolidation of Variable Interest Entities’’ (‘‘Interpretation 46(R)’’).

Application of this interpretation was required in our consolidated financial statements for the year ended

December 31, 2003, for interests in variable interest entities that were considered to be special-purpose entities.

Our Company determined that we did not have any arrangements or relationships with special-purpose entities.

Application of Interpretation 46(R) for all other types of variable interest entities was required for our Company

effective April 2, 2004.

Interpretation 46(R) addresses the consolidation of business enterprises to which the usual condition

(ownership of a majority voting interest) of consolidation does not apply. This interpretation focuses on

controlling financial interests that may be achieved through arrangements that do not involve voting interests. It

concludes that in the absence of clear control through voting interests, a company’s exposure (variable interest)

to the economic risks and potential rewards from the variable interest entity’s assets and activities is the best

68