McDonalds 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 McDonalds annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8 | McDonald’s Corporation 2013 Annual Report

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of

Equity Securities

MARKET INFORMATION AND DIVIDEND POLICY

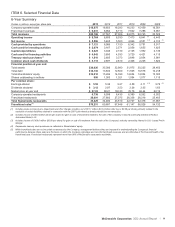

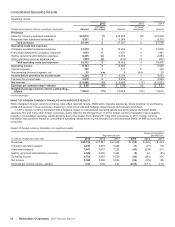

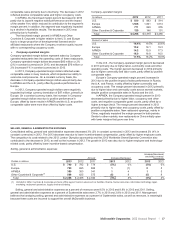

The Company’s common stock trades under the symbol MCD and is listed on the New York Stock Exchange in the U.S. The following table

sets forth the common stock price ranges on the New York Stock Exchange and dividends declared per common share:

2013 2012

Dollars per share High Low Dividend High Low Dividend

Quarter:

First 99.78 89.25 0.77 102.22 95.13 0.70

Second 103.70 95.16 0.77 99.50 85.92 0.70

Third 101.81 94.01 1.58 * 94.00 86.15 1.47 *

Fourth 99.27 93.14 94.16 83.31

Year 103.70 89.25 3.12 102.22 83.31 2.87

* Includes a $0.77 and $0.70 per share dividend declared and paid in third quarter of 2013 and 2012, respectively, and a $0.81 and $0.77 per share dividend

declared in third quarter and paid in fourth quarter of 2013 and 2012, respectively.

The number of shareholders of record and beneficial owners of the Company’s common stock as of January 31, 2014 was estimated to

be 1,824,000.

Given the Company’s returns on equity, incremental invested capital and assets, management believes it is prudent to reinvest in the

business in markets with acceptable returns and/or opportunity for long-term growth and use excess cash flow to return cash to

shareholders through dividends and share repurchases. The Company has paid dividends on common stock for 38 consecutive years

through 2013 and has increased the dividend amount at least once every year. As in the past, future dividend amounts will be considered

after reviewing profitability expectations and financing needs, and will be declared at the discretion of the Company’s Board of Directors.

ISSUER PURCHASES OF EQUITY SECURITIES

The following table presents information related to repurchases of common stock the Company made during the quarter ended

December 31, 2013*:

Period

Total Number of

Shares Purchased

Average Price

Paid per Share

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs(1)

Approximate Dollar

Value of Shares

that May Yet

Be Purchased Under

the Plans or Programs(1)

October 1-31, 2013 2,203,213 94.81 2,203,213 $ 7,750,841,405

November 1-30, 2013 1,360,592 97.63 1,360,592 7,618,005,790

December 1-31, 2013 1,840,646 95.85 1,840,646 7,441,571,916

Total 5,404,451 95.88 5,404,451

* Subject to applicable law, the Company may repurchase shares directly in the open market, in privately negotiated transactions, or pursuant to derivative

instruments and plans complying with Rule 10b5-1, among other types of transactions and arrangements.

(1) On July 19, 2012, the Company's Board of Directors approved a share repurchase program, effective August 1, 2012, that authorizes the purchase of up to

$10 billion of the Company's outstanding common stock with no specified expiration date.