McDonalds 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 McDonalds annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

McDonald’s Corporation 2013 Annual Report | 21

FINANCING AND MARKET RISK

The Company generally borrows on a long-term basis and is

exposed to the impact of interest rate changes and foreign

currency fluctuations. Debt obligations at December 31, 2013

totaled $14.1 billion, compared with $13.6 billion at December 31,

2012. The net increase in 2013 was primarily due to net issuances

of $535 million.

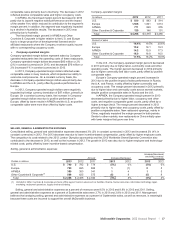

Debt highlights(1)

2013 2012 2011

Fixed-rate debt as a percent of total

debt(2,3) 74% 74% 69%

Weighted-average annual interest

rate of total debt(3) 4.0 4.0 4.2

Foreign currency-denominated debt

as a percent of total debt(2) 41 36 40

Total debt as a percent of total

capitalization (total debt and total

Shareholders' equity)(2) 47 47 46

Cash provided by operations as a

percent of total debt(2) 50 51 57

(1) All percentages are as of December 31, except for the weighted-average

annual interest rate, which is for the year.

(2) Based on debt obligations before the effect of fair value hedging

adjustments. This effect is excluded as these adjustments have no impact

on the obligation at maturity. See Debt financing note to the consolidated

financial statements.

(3) Includes the effect of interest rate swaps.

Fitch, Standard & Poor’s and Moody’s currently rate, with a

stable outlook, the Company’s commercial paper F1, A-1 and P-1,

respectively; and its long-term debt A, A and A2, respectively.

Certain of the Company’s debt obligations contain cross-

acceleration provisions and restrictions on Company and

subsidiary mortgages and the long-term debt of certain

subsidiaries. There are no provisions in the Company’s debt

obligations that would accelerate repayment of debt as a result of

a change in credit ratings or a material adverse change in the

Company’s business. Under existing authorization from the

Company’s Board of Directors, at December 31, 2013, the

Company had $3.6 billion of authority remaining to borrow funds,

including through (i) public or private offering of debt securities;

(ii) direct borrowing from banks or other financial institutions; and

(iii) other forms of indebtedness. In addition to debt securities

available through a medium-term notes program registered with

the U.S. Securities and Exchange Commission ("SEC") and a

Global Medium-Term Notes program, the Company has $1.5

billion available under a committed line of credit agreement as well

as authority to issue commercial paper in the U.S. and global

markets (see Debt Financing note to the consolidated financial

statements). Debt maturing in 2014 is approximately $530 million

of long-term corporate debt. In 2014, the Company expects to

issue commercial paper and long-term debt to refinance this

maturing debt. As of December 31, 2013, the Company's

subsidiaries also had $610 million of borrowings outstanding,

primarily under uncommitted foreign currency line of credit

agreements.

The Company uses major capital markets, bank financings

and derivatives to meet its financing requirements and reduce

interest expense. The Company manages its debt portfolio in

response to changes in interest rates and foreign currency rates

by periodically retiring, redeeming and repurchasing debt,

terminating swaps and using derivatives. The Company does not

hold or issue derivatives for trading purposes. All swaps are over-

the-counter instruments.

In managing the impact of interest rate changes and foreign

currency fluctuations, the Company uses interest rate swaps and

finances in the currencies in which assets are denominated. The

Company uses foreign currency debt and derivatives to hedge the

foreign currency risk associated with certain royalties,

intercompany financings and long-term investments in foreign

subsidiaries and affiliates. This reduces the impact of fluctuating

foreign currencies on cash flows and shareholders’ equity. Total

foreign currency-denominated debt was $5.8 billion and

$4.9 billion for the years ended December 31, 2013 and 2012,

respectively. In addition, where practical, the Company’s

restaurants purchase goods and services in local currencies

resulting in natural hedges. See the Summary of significant

accounting policies note to the consolidated financial statements

related to financial instruments and hedging activities for additional

information regarding the accounting impact and use of

derivatives.

The Company does not have significant exposure to any

individual counterparty and has master agreements that contain

netting arrangements. Certain of these agreements also require

each party to post collateral if credit ratings fall below, or

aggregate exposures exceed, certain contractual limits. At

December 31, 2013, neither the Company nor its counterparties

were required to post collateral on any derivative position, other

than on hedges of certain of the Company’s supplemental benefit

plan liabilities where our counterparty was required to post

collateral on its liability position.

The Company’s net asset exposure is diversified among a

broad basket of currencies. The Company’s largest net asset

exposures (defined as foreign currency assets less foreign

currency liabilities) at year end were as follows:

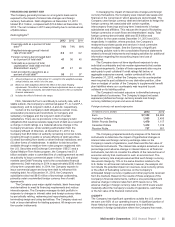

Foreign currency net asset exposures

In millions of U.S. Dollars 2013 2012

Euro $ 7,302 $ 6,692

Australian Dollars 1,933 2,450

British Pounds Sterling 1,479 1,117

Canadian Dollars 1,412 1,319

Russian Ruble 737 651

The Company prepared sensitivity analyses of its financial

instruments to determine the impact of hypothetical changes in

interest rates and foreign currency exchange rates on the

Company’s results of operations, cash flows and the fair value of

its financial instruments. The interest rate analysis assumed a one

percentage point adverse change in interest rates on all financial

instruments, but did not consider the effects of the reduced level of

economic activity that could exist in such an environment. The

foreign currency rate analysis assumed that each foreign currency

rate would change by 10% in the same direction relative to the

U.S. Dollar on all financial instruments; however, the analysis did

not include the potential impact on revenues, local currency prices

or the effect of fluctuating currencies on the Company’s

anticipated foreign currency royalties and other payments received

from the markets. Based on the results of these analyses of the

Company’s financial instruments, neither a one percentage point

adverse change in interest rates from 2013 levels nor a 10%

adverse change in foreign currency rates from 2013 levels would

materially affect the Company’s results of operations, cash flows

or the fair value of its financial instruments.

LIQUIDITY

The Company has significant operations outside the U.S. where

we earn over 60% of our operating income. A significant portion of

these historical earnings are considered to be indefinitely

reinvested in foreign jurisdictions where the Company has made,