McDonalds 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 McDonalds annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 | McDonald’s Corporation 2013 Annual Report

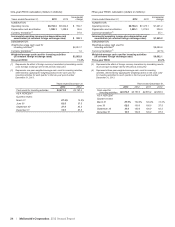

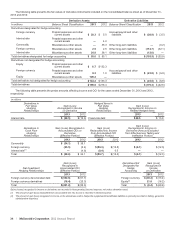

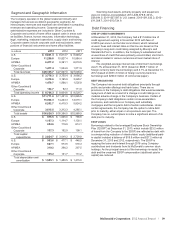

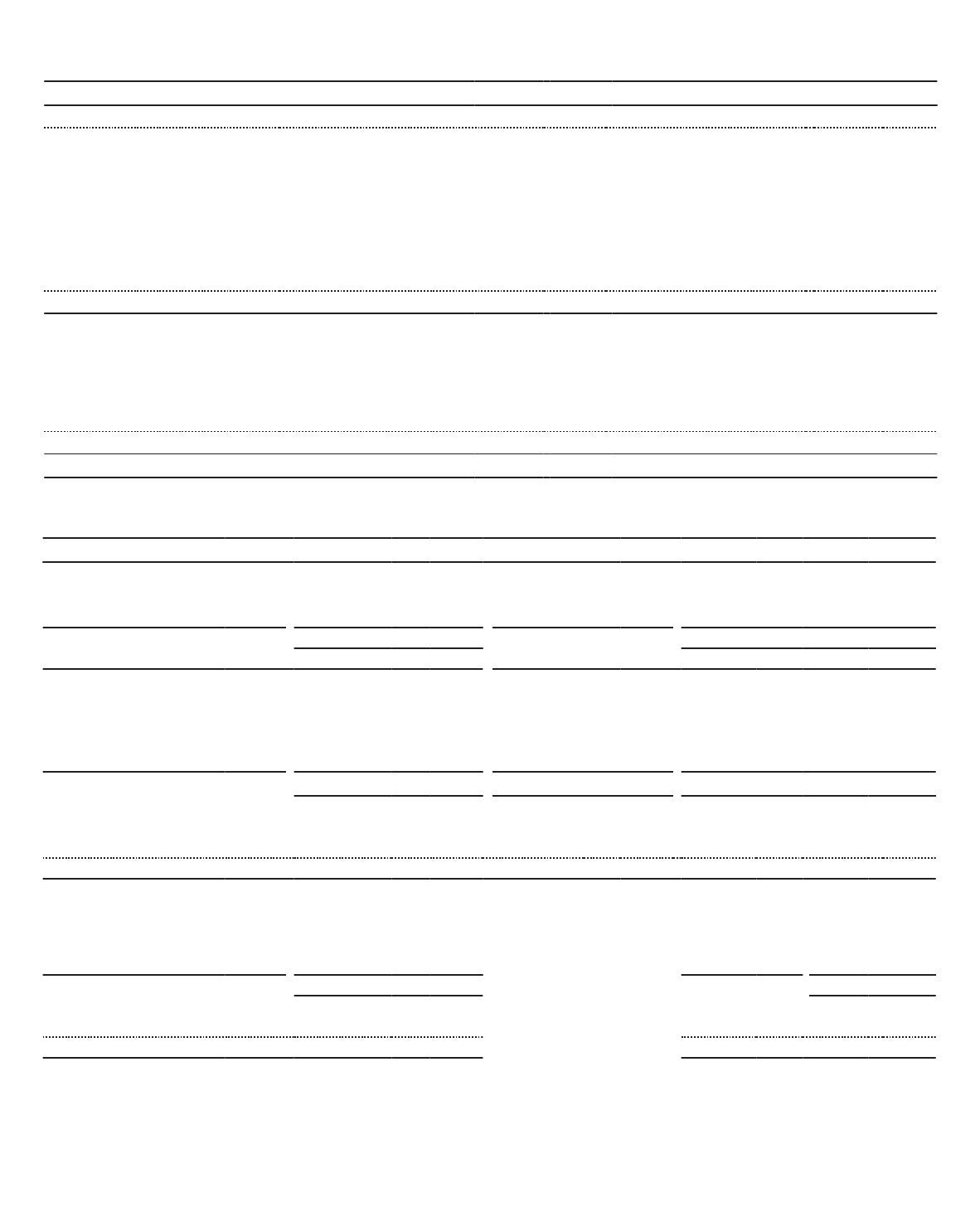

The following table presents the fair values of derivative instruments included on the Consolidated balance sheet as of December 31,

2013 and 2012:

Derivative Assets Derivative Liabilities

In millions Balance Sheet Classification 2013 2012 Balance Sheet Classification 2013 2012

Derivatives designated for hedge accounting

Foreign currency Prepaid expenses and other

current assets $ 28.3 $ 5.0

Accrued payroll and other

liabilities $ (28.8) $ (3.5)

Interest rate Prepaid expenses and other

current assets —4.2

Commodity Miscellaneous other assets —35.3 Other long-term liabilities —(0.2)

Foreign currency Miscellaneous other assets 2.5 2.5 Other long-term liabilities (114.7) (32.1)

Interest rate Miscellaneous other assets 24.8 38.1 Other long-term liabilities (12.0) —

Total derivatives designated for hedge accounting $ 55.6 $ 85.1 $ (155.5) $ (35.8)

Derivatives not designated for hedge accounting

Equity Prepaid expenses and other

current assets $ 6.7 $ 132.3

Foreign currency Prepaid expenses and other

current assets 9.3 1.0

Accrued payroll and other

liabilities $ (23.8) $ (6.8)

Equity Miscellaneous other assets 128.2 —

Total derivatives not designated for hedge accounting $ 144.2 $ 133.3 $ (23.8) $ (6.8)

Total derivatives $ 199.8 $ 218.4 $ (179.3) $ (42.6)

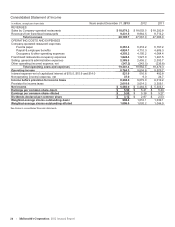

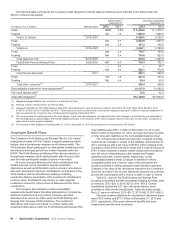

The following table presents the pretax amounts affecting income and OCI for the years ended December 31, 2013 and 2012,

respectively:

In millions

Derivatives in

Fair Value

Hedging

Relationships

Gain (Loss)

Recognized in Income

on Derivative

Hedged Items in

Fair Value

Hedging

Relationships

Gain (Loss)

Recognized in Income on

Related Hedged Items

2013 2012 2013 2012

Interest rate $ (29.5) $ (13.0) Fixed-rate debt $29.5 $ 13.0

Derivatives in

Cash Flow

Hedging

Relationships

Gain (Loss) Recognized in

Accumulated OCI on

Derivative

(Effective Portion)

Gain (Loss)

Reclassified into Income

from Accumulated OCI

(Effective Portion)

Gain (Loss)

Recognized in Income on

Derivative (Amount Excluded

from Effectiveness Testing and

Ineffective Portion)

2013 2012 2013 2012 2013 2012

Commodity $ (34.1) $ 35.1

Foreign currency (65.5) (6.4) $ (50.3) $ (15.8) $ (6.1) $ (12.3)

Interest rate(1) —(4.6) (0.4) 0.5 ——

Total $ (99.6) $ 24.1 $ (50.7) $ (15.3) $ (6.1) $ (12.3)

Gain (Loss)

Recognized in

Accumulated OCI

(Effective Portion)

Derivatives Not

Designated for

Hedge

Accounting

Gain (Loss)

Recognized in

Income

on Derivative

Net Investment

Hedging Relationships

2013 2012 2013 2012

Foreign currency denominated debt $(382.8) $ (61.7) Foreign currency $ (30.2) $ (13.4)

Foreign currency derivatives (18.4) (23.3) Equity(2) 21.8 (16.2)

Total $(401.2) $ (85.0) Total $ (8.4) $ (29.6)

Gains (losses) recognized in income on derivatives are recorded in Nonoperating (income) expense, net unless otherwise noted.

(1) The amount of gain (loss) reclassified from accumulated OCI into income is recorded in Interest expense.

(2) The amount of gain (loss) recognized in income on the derivatives used to hedge the supplemental benefit plan liabilities is primarily recorded in Selling, general &

administrative expenses.