McDonalds 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 McDonalds annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

McDonald’s Corporation 2013 Annual Report | 37

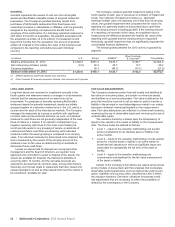

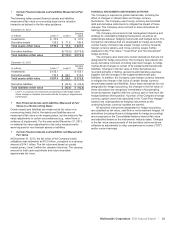

Franchise Arrangements

Conventional franchise arrangements generally include a lease

and a license and provide for payment of initial fees, as well as

continuing rent and royalties to the Company based upon a

percent of sales with minimum rent payments that parallel the

Company’s underlying leases and escalations (on properties that

are leased). Under this arrangement, franchisees are granted the

right to operate a restaurant using the McDonald’s System and, in

most cases, the use of a restaurant facility, generally for a period

of 20 years. These franchisees pay related occupancy costs

including property taxes, insurance and maintenance. Affiliates

and developmental licensees operating under license agreements

pay a royalty to the Company based upon a percent of sales, and

may pay initial fees.

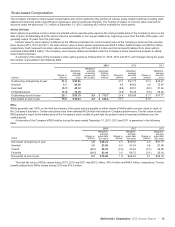

Revenues from franchised restaurants consisted of:

In millions 2013 2012 2011

Rents $6,054.4 $5,863.5 $ 5,718.5

Royalties 3,100.4 3,032.6 2,929.8

Initial fees 76.7 68.4 64.9

Revenues from franchised

restaurants $9,231.5 $8,964.5 $ 8,713.2

Future minimum rent payments due to the Company under

existing franchise arrangements are:

In millions Owned sites Leased sites Total

2014 $ 1,321.4 $ 1,381.8 $ 2,703.2

2015 1,279.4 1,332.3 2,611.7

2016 1,228.5 1,278.2 2,506.7

2017 1,166.9 1,209.7 2,376.6

2018 1,121.9 1,138.6 2,260.5

Thereafter 9,636.4 8,405.8 18,042.2

Total minimum payments $15,754.5 $14,746.4 $30,500.9

At December 31, 2013, net property and equipment under

franchise arrangements totaled $15.5 billion (including land of $4.4

billion) after deducting accumulated depreciation and amortization

of $8.1 billion.

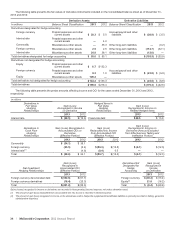

Leasing Arrangements

At December 31, 2013, the Company was the lessee at 14,815

restaurant locations through ground leases (the Company leases

the land and the Company or franchisee owns the building) and

through improved leases (the Company leases land and

buildings). Lease terms for most restaurants, where market

conditions allow, are generally for 20 years and, in many cases,

provide for rent escalations and renewal options, with certain

leases providing purchase options. Escalation terms vary by

geographic segment with examples including fixed-rent

escalations, escalations based on an inflation index, and fair-value

market adjustments. The timing of these escalations generally

ranges from annually to every five years. For most locations, the

Company is obligated for the related occupancy costs including

property taxes, insurance and maintenance; however, for

franchised sites, the Company requires the franchisees to pay

these costs. In addition, the Company is the lessee under non-

cancelable leases covering certain offices and vehicles.

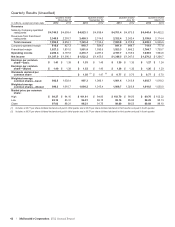

The following table provides detail of rent expense:

In millions 2013 2012 2011

Company-operated

restaurants:

U.S. $ 61.6 $ 59.1 $ 55.9

Outside the U.S. 713.4 661.0 620.4

Total 775.0 720.1 676.3

Franchised restaurants:

U.S. 441.6 433.0 420.0

Outside the U.S. 572.0 519.7 514.7

Total 1,013.6 952.7 934.7

Other 104.0 104.2 101.7

Total rent expense $1,892.6 $1,777.0 $ 1,712.7

Rent expense included percent rents in excess of minimum

rents (in millions) as follows–Company-operated restaurants:

2013–$175.6; 2012–$169.6; 2011–$165.2. Franchised

restaurants: 2013–$187.4; 2012–$178.7; 2011–$173.4.

Future minimum payments required under existing operating

leases with initial terms of one year or more are:

In millions Restaurant Other Total

2014 $ 1,361.5 $ 78.9 $ 1,440.4

2015 1,266.3 67.5 1,333.8

2016 1,160.4 57.9 1,218.3

2017 1,051.4 47.4 1,098.8

2018 947.7 42.0 989.7

Thereafter 7,444.9 187.0 7,631.9

Total minimum payments $13,232.2 $ 480.7 $13,712.9

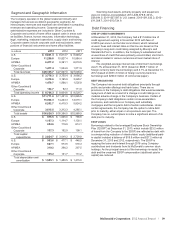

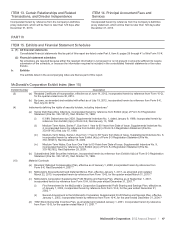

Income Taxes

Income before provision for income taxes, classified by source of

income, was as follows:

In millions 2013 2012 2011

U.S. $2,912.7 $2,879.7 $ 3,202.8

Outside the U.S. 5,291.8 5,199.3 4,809.4

Income before provision for

income taxes $8,204.5 $ 8,079.0 $8,012.2

The provision for income taxes, classified by the timing and

location of payment, was as follows:

In millions 2013 2012 2011

U.S. federal $1,238.2 $1,129.9 $ 1,173.4

U.S. state 175.0 189.8 165.2

Outside the U.S. 1,180.2 1,160.0 982.1

Current tax provision 2,593.4 2,479.7 2,320.7

U.S. federal 46.2 144.9 189.0

U.S. state (6.7) 5.5 8.6

Outside the U.S. (14.3) (15.9) (9.2)

Deferred tax provision 25.2 134.5 188.4

Provision for income taxes $2,618.6 $2,614.2 $ 2,509.1