Starbucks 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Starbucks Corporation 2014 Form 10-K 73

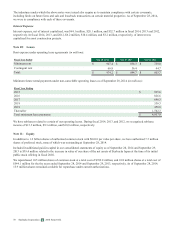

Stock option transactions for the year ended September 28, 2014 (in millions, except per share and contractual life amounts):

Shares

Subject to

Options

Weighted

Average

Exercise

Price

per Share

Weighted

Average

Remaining

Contractual

Life (Years)

Aggregate

Intrinsic

Value

Outstanding, September 29, 2013 22.0 $ 29.11 6.0 $ 1,060

Granted 3.1 80.23

Exercised (4.8) 24.27

Expired/forfeited (0.5) 51.80

Outstanding, September 28, 2014 19.8 37.86 5.8 754

Exercisable, September 28, 2014 12.7 25.32 4.4 631

Vested and expected to vest, September 28, 2014 19.2 36.89 5.7 747

The aggregate intrinsic value in the table above, which is the amount by which the market value of the underlying stock

exceeded the exercise price of outstanding options, is before applicable income taxes and represents the amount optionees

would have realized if all in-the-money options had been exercised on the last business day of the period indicated.

As of September 28, 2014, total unrecognized stock-based compensation expense, net of estimated forfeitures, related to

nonvested stock options was approximately $35 million, before income taxes, and is expected to be recognized over a weighted

average period of approximately 2.6 years. The total intrinsic value of stock options exercised was $258 million, $539 million,

and $440 million during fiscal years 2014, 2013, and 2012, respectively. The total fair value of options vested was $44 million,

$56 million, and $59 million during fiscal years 2014, 2013, and 2012, respectively.

RSUs

We have both time-vested and performance-based RSUs. Time-vested RSUs are awarded to eligible employees and non-

employee directors and entitle the grantee to receive shares of common stock at the end of a vesting period, subject solely to the

employee’s continuing employment or the non-employee director's continuing service. The majority of RSUs vest in two equal

annual installments beginning a year from the grant date. Our performance-based RSUs are awarded to eligible employees and

entitle the grantee to receive shares of common stock if we achieve specified performance goals during the performance period

and the grantee remains employed during the subsequent vesting period.

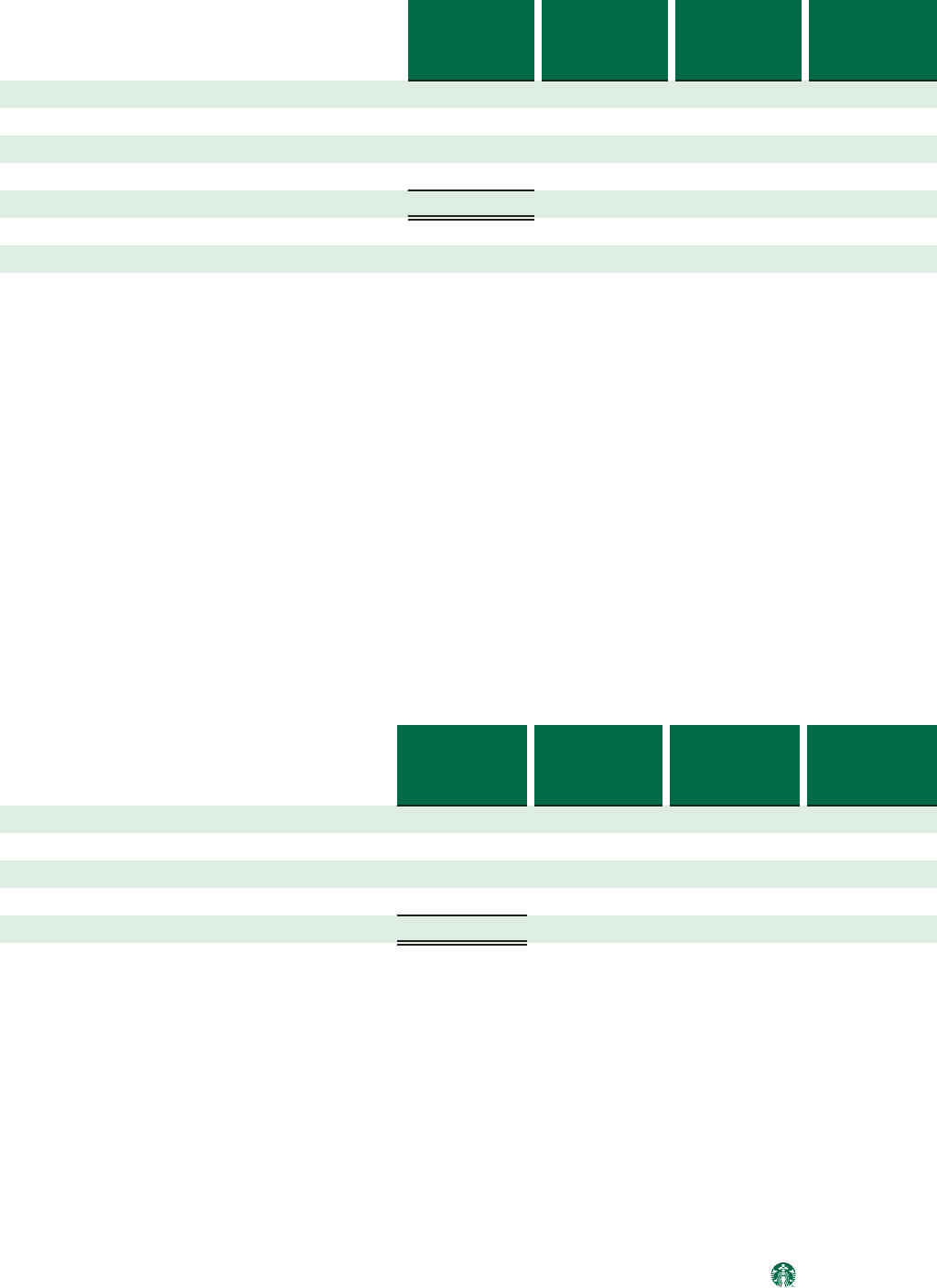

RSU transactions for the year ended September 28, 2014 (in millions, except per share and contractual life amounts):

Number

of

Shares

Weighted

Average

Grant Date

Fair Value

per Share

Weighted

Average

Remaining

Contractual

Life (Years)

Aggregate

Intrinsic

Value

Nonvested, September 29, 2013 5.8 $ 44.08 0.9 $ 452

Granted 2.9 80.13

Vested (2.6) 40.08

Forfeited/canceled (0.7) 65.59

Nonvested, September 28, 2014 5.4 62.34 1.0 407

For fiscal 2013 and 2012, the weighted average fair value per RSU granted was $50.23 and $44.05, respectively. As of

September 28, 2014, total unrecognized stock-based compensation expense related to nonvested RSUs, net of estimated

forfeitures, was approximately $113 million, before income taxes, and is expected to be recognized over a weighted average

period of approximately 2.0 years. The total fair value of RSUs vested was $103 million, $104 million and $80 million during

fiscal years 2014, 2013, and 2012, respectively.

ESPP

Our ESPP allows eligible employees to contribute up to 10% of their base earnings toward the quarterly purchase of our

common stock, subject to an annual maximum dollar amount. The purchase price is 95% of the fair market value of the stock

on the last business day of the quarterly offering period. The number of shares issued under our ESPP was 0.4 million in fiscal

2014.