Starbucks 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Starbucks Corporation 2014 Form 10-K 81

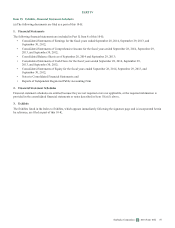

Note 17: Selected Quarterly Financial Information (unaudited; in millions, except EPS)

First

Quarter Second

Quarter Third

Quarter Fourth

Quarter Full

Year

Fiscal 2014:

Net revenues $ 4,239.6 $ 3,873.8 $ 4,153.7 $ 4,180.8 $ 16,447.8

Operating income 813.5 644.1 768.5 854.9 3,081.1

Net earnings attributable to Starbucks 540.7 427.0 512.6 587.9 2,068.1

EPS — diluted 0.71 0.56 0.67 0.77 2.71

Fiscal 2013:

Net revenues(1) $ 3,793.2 $ 3,549.6 $ 3,735.3 $ 3,788.8 $ 14,866.8

Operating income/(loss)(2) 630.6 544.1 615.2 (2,115.2)(325.4)

Net earnings/(loss) attributable to Starbucks(2) 432.2 390.4 417.8 (1,232.0) 8.3

EPS — diluted(2) 0.57 0.51 0.55 (1.64) 0.01

(1) Includes the reclassifications resulting from the correction of the immaterial error discussed in Note 1, Summary of

Significant Accounting Policies. We reclassified $6.4 million, $6.3 million, $6.4 million and $6.2 million for the first,

second, third, and fourth quarters of fiscal year 2013, respectively, and $25.4 million for the full year of fiscal 2013.

(2) The fourth quarter of fiscal 2013 includes a pretax charge of $2,784.1 million resulting from the conclusion of the

arbitration with Kraft.

Note 18: Subsequent Event

On September 23, 2014, we entered into a tender offer bid agreement with Starbucks Coffee Japan, Ltd. ("Starbucks Japan"), a

39.5% owned equity method investment (as discussed in Note 6, Equity and Cost Investments), and our joint venture partner,

Sazaby League, Ltd. ("Sazaby"), to acquire the remaining 60.5% ownership interest in Starbucks Japan. We are acquiring

Starbucks Japan to further leverage our existing infrastructure to continue disciplined retail store growth and expand our

presence into other channels in the Japan market, such as CPG, licensing and foodservice. Structured as a two-step tender offer,

the full acquisition of Starbucks Japan is expected to be completed during fiscal 2015.

On October 31, 2014, we acquired Sazaby's 39.5% ownership interest through the first tender offer step for ¥55 billion ($511

million) in cash, bringing our total ownership in Starbucks Japan to a controlling 79% interest. Due to the limited time since the

closing of the first tender offer step, the initial accounting for this acquisition is still in process but will be reflected in our first

quarter of fiscal 2015 results. We will record the fair value of the assets acquired and liabilities assumed as of October 31, 2014,

as well as adjust the carrying value of our existing 39.5% equity method investment to fair value. From the acquisition date

forward, we will consolidate Starbucks Japan's results of operations and cash flows in our consolidated financial statements.

Until the remaining 21% of minority shareholders’ interests are acquired, we will present them as net earnings attributable to

noncontrolling interests in our consolidated statements of earnings.

We initiated the second tender offer step on November 10, 2014 to acquire the remaining 21% ownership interest held by the

public shareholders and option holders of Starbucks Japan's common stock, with the objective of acquiring all of the remaining

outstanding shares including outstanding stock options, which we expect to complete on December 29, 2014. Upon successful

completion of the second tender offer step, we intend to commence a cash-out procedure under Japanese law (the "Cash-out")

that will allow us to acquire all remaining shares. At the conclusion of the Cash-out, which we expect to complete during the

first half of calendar 2015, Starbucks will own 100% of Starbucks Japan. The expected purchase price for the second tender

offer step and the Cash-out is ¥44.5 billion (approximately $382 million with Japanese yen converted into US dollars at a

reference conversion rate of 116.52 JPY to USD).

We funded the first tender offer step with $511 million in offshore cash. We also expect to fund a majority of the second tender

offer step with offshore cash. Through the date of this filing, we have incurred approximately $5 million in acquisition-related

costs, such as regulatory, legal, and advisory fees, which we have recorded within unallocated corporate general and

administrative expenses during the respective fiscal periods in which they were incurred.